Many investors that are in a 1031 exchange that are tired of actively managing their investment properties and are looking to diversify* their 1031 exchange eligible equity as opposed to buying a single property again often ask themselves, “Can I 1031 exchange into a REIT?” The answer is yes—not directly—but indirectly, as part of a multi-part process. An investor is not able to do a direct 1031 exchange into a REIT since REIT shares are … Read More

A Client’s First Experience with DSTs

Case Study: A Client’s First Experience with DSTs By Betty Friant, Senior Vice President, Kay Properties & Investments, LLC The client has invested in real estate since 1987. After experiencing difficulties in renting an industrial property she owned for the past 13 years, it was time to sell. Having sold many properties in the past, the concept of doing a 1031 exchange was all too familiar to her. She questioned whether or not to do … Read More

Kay Properties 1031 DST Team Continues to Grow

Alex Madden is the latest team member to join Kay Properties and Investments, LLC. Alex’s experience within Management Consulting at KPMG, serving clients like the US Department of Housing and Urban Development (HUD) and the Federal Housing Administration (FHA), have provided him with an excellent background in single and multi-family housing. Previously, Alex served as an Army Ranger as an Executive Officer, and Chief of Staff in the Special Operations community, including multiple deployments to … Read More

How Kay Properties and Investments Works With Real Estate Brokers

Securing Listing Agreements: Many brokers have expressed that their investors want to do a 1031 exchange but are afraid of not being able to locate and close on their replacement property within the 1031 exchange timeframe. The Delaware statutory trusts have been secured and pre-packaged prior to being available to investors, and therefore potentially reduce closing risk. Delaware statutory trusts can typically be identified and closed on within 24-72 hours. This helps with the sale … Read More

Is a 1031 Exchange Triple Net Lease the Way to Go for You?

By Chay Lapin – Senior Vice President Kay Properties and Investments Please find below a case study when considering purchasing NNN properties versus alternative options such as DSTs. Is a NNN Property the way to go for my 1031 exchange? Are you considering to purchase and manage a (NNN) Net Lease Property on your own? Important Questions to Ask 1. Are you prepared for the potential active management? NNN properties are only passive if everything … Read More

Hotel Retirement Solution: 1031 Exchange into DSTs

Hotel owners frequently contact Kay Properties and Investments looking for a retirement solution. They have labored for decades building up their business and now it is time to sell the property and retire. However, optimism is often replaced by anxiety when their CPA calculates the tax consequence to discover the standard of living hoped for may not be feasible. Kay Properties and Investments works with hotel owners to help achieve their retirement goals through a … Read More

Charlotte Pharmacy Press Release

Los Angeles, CA and Charlotte, NC Kay Properties and Investments, LLC has successfully completed a $5,436,250 equity raise for the Charlotte Pharmacy DST. The Charlotte Pharmacy DST is an all-cash/debt-free DST investment that owns a 100% occupied Walgreens Pharmacy located in Charlotte, NC. The property enjoys a long-term net lease with a Walgreens corporate guarantee as well as the property is located on a signalized intersection with a combined traffic count of 41,000 vehicles per … Read More

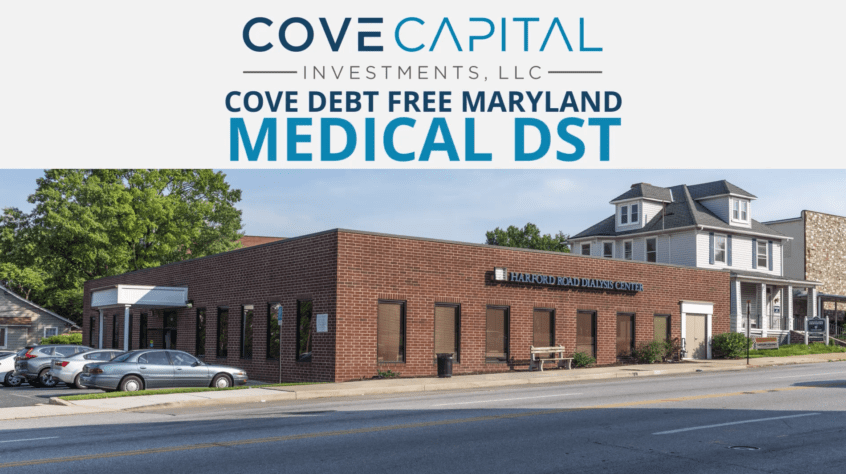

Maryland Medical Press Release

Los Angeles, CA and Baltimore, MD Kay Properties Completes DST 1031 Offering in Baltimore Maryland Kay Properties and Investments, LLC has completed another equity raise on a 100% occupied net lease property in Baltimore, MD. The Maryland Medical DST offering is a 100% occupied Davita Dialysis medical clinic located in Baltimore, MD. The property benefits from a long-term net lease corporately guaranteed by DaVita (NYSE: DVA) as well as that the offering is an all … Read More

Questions to Ask When Investing in DSTs

By: Kay Properties and Investments, LLC Investors often approach Kay Properties and Investments to expand their investment research into Delaware Statutory Trusts (DSTs) after speaking with a friend, registered rep, or advisor about the opportunity. Unfortunately, we continue to discover that whoever is advising the client has been providing incorrect or incomplete information. DSTs are sophisticated investment vehicles that require a niche expertise. We have developed a series of questions for investors to ask their … Read More

Kay Properties and Investments Launches the Kay DST Secondary Market

Los Angeles, CA Every client of Kay Properties and Investments has been advised regarding DSTs lack of liquidity. One should invest in DSTs with the anticipation of holding their DST investment for five to ten years and potentially even longer. However, now clients of Kay Properties and Investments can potentially benefit from the opportunity to sell their DST 1031 investments early when unforeseen life events require an urgent need for cash. “We are excited to … Read More

1031 Exchanging Into a REIT: The 721 UPREIT as an Option for Investors

By: Orrin Barrow, Vice President at Kay Properties and Investments, LLC Here at Kay Properties, we have many clients who inquire about different 1031 exchange options. Some of our investors have inquired about the 721 UPREIT (Umbrella Partnership Real Estate Investment Trust) mechanism in both DSTs and Private and Publicly Registered Non-Traded REITS. The question that many investors ask is – Can I 1031 Exchange into a REIT? The 721 UPREIT can be a potential … Read More

Kay Properties and Investments: How Kay Properties Helps Real Estate Brokers

We all know that completing a 1031 exchange can be a very daunting task. The 1031 exchange guidelines state that an investor has 45 days after the date of the sale to identify replacement property and then 180 days to complete the exchange. This includes weekends and holidays. Many brokers and investors alike have expressed that this timeline comes very quickly. What complicates matters even more is that many times brokers and their clients are … Read More

STOP! DON’T FILE YOUR TAXES NEXT APRIL IF YOU START A 1031 EXCHANGE IN THE LAST QUARTER OF THE YEAR

Betty Friant, Senior Vice President overseeing the Washington DC office of Kay Properties recently interviewed CEO and Founder, Dwight Kay about a very important topic for anyone thinking of doing a 1031 Exchange in the last quarter of the year. Betty Friant: So, Dwight. Thanks for taking the time to go over a critical part of the 1031 Exchange process. Why is Mid-October such an important date in the 1031 Exchange world? Dwight Kay: The … Read More

11 Reasons We Like Chicago, IL

1. Chicago is the third largest city in the United States with a population of nearly 3 million people1 and a larger metropolitan area population of over 7 million people 6 2. Chicago headquarters many Fortune 500 companies, including Boeing, Motorola Solutions, Archer Daniels Midland, United Continental Holdings, Exelon, AbbVie, LKQ, Conagra Brands, Old Republic International and more. 4 3. Chicago houses Google’s Midwest headquarters with over 800 employees, and plans for expansion.2 4. Chicago … Read More

10 Reasons Why Clients Choose To Work With Kay Properties as They Purchase DST 1031 Investments

So, you’re ready to sell your property and make a 1031 exchange into a DST property. You can almost taste the retirement piña coladas and feel the gentle wind of the golf course on your face. Aside from finding the right Qualified Intermediary to help you make the exchange, you want to find a firm you can trust to help you find DST properties so that you can enjoy retirement. Here’s why hundreds of DST … Read More

Why Kay Properties Prefers a Delaware Statutory Trust over a Tenant in Common (DST vs TIC)

If you’re an investor considering a 1031 exchange in order to defer the Capital Gains Tax and its friends, chances are you’re looking at a Delaware Statutory Trust or a Tenant in Common to take a step back while your passive investment does the work for you. The real question is, which one is best for you? A DST or a TIC? Please keep in mind that any investment comes with risks. We urge you … Read More

Do you own investment real estate? Have you recently assessed its value and considered selling the property? If so, we have important news for you….

By Dwight Kay and the Kay Properties Team A 1031 exchange is considered by many to be the most effective tax deferral tool available. Under IRS code section 1031, investment real estate owners are able to defer the capital gain tax on the sale of appreciated investment property if they reinvest in “like-kind” property. Real estate held for business or investment purposes can qualify as “like-kind” property. This includes single-family rentals, apartment complexes, office buildings, … Read More

1031 DST Investments: Why All-Cash/Debt-Free Delaware Statutory Trust Properties

10 Reasons to Consider All-Cash/Debt-Free DST Properties For Your 1031 Exchange No refinancing risk. Flexibility to hold through any potential market downturns, credit crunches, recessions and/or depressions. Provides 1031 investors the ability to diversify* a portion of their exchange dollars into an all-cash/debt-free property in an effort to lower potential risk. Eliminates the risk of taking on equal or greater debt in future 1031 exchanges. If an investor that was debt free purchases leveraged properties … Read More

10 Reasons We Like DaVita Dialysis as the Tenant of our DST 1031 Exchange Investments

DaVita is a Fortune 500® company publicly traded on the NYSE as DVA3 DaVita Kidney Care is a leading provider of kidney care in the United States, with clinical outcomes that were the best or among the best in the United States in almost every category in 20171 DaVita has a market capitalization of $12.8 billion as of August 6, 20184 DaVita has 70,800 full time employees2 DaVita had annual revenue of $11.11 billion in … Read More

DST 1031 Exchange: What is it and How Might it Help with my Current 1031 Exchange

So you’ve decided to do a 1031 exchange, meaning you have decided to sell your property and invest that money in another property in order to defer the federal capital gains tax, state capital gains tax, depreciation recapture tax and the Medicare surtax. Smart! divBut are you just moving from one headache to another? If you’re looking to retire from property management but you still want to defer your taxes using a 1031 exchange and … Read More

What is a DST 1031? Delaware Statutory Trust Ownership Explained

What is a DST 1031? I’m hearing my real estate investor friends and CPA mention it may be a good exit strategy for my appreciated real estate but I need to know more about it… First, let us explain a DST. DST stands for Delaware Statutory Trust. Here’s the full technical definition: a separate legal entity established under a trust created for the purpose of holding, managing, administering, investing, or operating a property, or for … Read More

10 Reasons We Like FedEx as a Tenant for our 1031 DST Investments

FedEx made $60.3 billion in revenue at the end of the 2017 fiscal year FedEx made $5 billion record operating profit at the end of the 2017 fiscal year FexEx has over 55 million unique visitors online per month FedEx gets 125 million package-status tracking requests daily FedEx moves an average of 14 million shipments each business day FexEx ships to over 220 countries and territories FexEx has been recognized by Fortune Magazine as one … Read More

Kay Properties Executive Participates in 16th Annual RealShare Net Lease Conference Panel

By: Jason Salmon – Senior Vice President and Managing Director of Real Estate Analytics Represented Kay Properties by Lending Expertise to an Audience of Industry Professionals NEW YORK, April 09, 2018 (GLOBE NEWSWIRE) — Last week’s RealShare Net Lease Conference panel sessions covered a range of topics including net lease real estate, capital markets, the economy, the 1031 exchange market, institutional vs. private real estate buyers/sellers and current trends among various commercial and residential real … Read More

Press Release: Kay Properties has Successfully Completed the Tampa International Business Center 1 DST in Tampa, FL on Behalf of 1031 Exchange Investors

Los Angeles, CA and Tampa, FL Kay Properties has successfully completed the Tampa International Business Center 1 DST in Tampa, FL. This DST property was made available to accredited investors under Regulation D Rule 506c and had a total offering equity raise of $9,300,000. The Tampa International Business Center 1 DST was an all-cash/debt-free DST offering available for 1031 exchange and direct cash investors. The property was a 50,018 square foot, two-building portfolio that is … Read More

Kay Properties Completes Delaware Statutory Trust (DST) Offering in Richmond, VA

Los Angeles, CA and Richmond, VA Kay Properties has successfully completed the Maple Springs Apartments DST in Richmond, VA. This DST property was made available to accredited investors under Regulation D Rule 506c and had a total investment cost of $27,388,000. The Maple Springs Apartments DST was a 268-unit apartment community in Richmond, VA. The property was a multifamily apartment investment opportunity available for 1031 exchange and direct cash investors. Dwight Kay, Founder and CEO … Read More

Kay Properties Closes Delaware Statutory Trust (DST) Property in Orange Park (Jacksonville MSA), FL

Los Angeles, CA and Orange Park (Jacksonville MSA), FL Kay Properties has successfully completed the Alexander Pointe Apartments DST in Jacksonville, FL. This DST property was made available to accredited investors under Regulation D Rule 506c and had a total investment cost of $24,026,000. The Alexander Pointe Apartments DST was a 232-unit apartment community in Orange Park, FL. The property was a value-add investment opportunity available for 1031 exchange and direct cash investors. Dwight Kay, … Read More

Kay Properties Successfully Completes the Equity Raise For a Delaware Statutory Trust (DST) 1031 Exchange Investment in Norfolk, VA

Los Angeles, CA and Norfolk, VA Kay Properties has successfully completed raising equity capital for the 150 Corporate DST in Norfolk, VA. This DST investment was made available to accredited 1031 exchange and direct cash investors under Regulation D Rule 506c. The 56,052 square foot property is 100% occupied by a public company. Being that this is the company’s headquarters, this particular location is considered critical to the tenant’s mission and success. The property boasts … Read More

1031 Exchange Delaware Statutory Trust Investment Announcement: Another Completed 1031 Exchange DST Investment by Kay Properties

Los Angeles, CA and Brookings, OR Kay Properties has successfully completed raising equity capital for the Brookings DST in Brookings, OR. This DST investment opportunity was made available to accredited 1031 exchange and direct cash investors under Regulation D Rule 506c. The property is 100% occupied by FedEx Ground Packaging Systems, Ltd. The investors purchased their DST investments on an all-cash/debt-free basis with no long-term mortgage financing. Dwight Kay, Founder and CEO of Kay Properties … Read More

How Real Estate Agents and Brokers are Using Kay Properties 1031 Delaware Statutory Trust (DST) Properties To Get More Listings and Help Their Clients

Real estate agents and brokers in today’s market can utilize Kay Properties Delaware Statutory Trust (DST) properties in a number of ways. This article goes into detail as to how numerous agents and brokers have worked with Kay Properties over the years to help their clients involved in 1031 exchanges and all the while growing their business through new listing opportunities.

Delaware Statutory Trust Relations & Portfolios—What? Who? Where? When? Why? …And How?

By: Jason Salmon, Senior Vice President – Kay Properties and Investments, LLC A DST is a Delaware Statutory Trust. Further, the DST structure has been adopted as a form of ownership used to allow private investors to own fractional interests in institutional real estate. Further still, this form of passive real estate ownership affords investors the opportunity to diversify* their real estate holdings by geography, property sector and asset manager. Moreover, DSTs qualify as “like-kind” … Read More

Why Debt Can Hurt You: DST 1031 Exchange Property Market Insights – Example DST 1031 Case Study

Recently a client in a 1031 Exchange with $4,000,000 of equity was working with another registered representative and talking to a sponsor directly. In talking with Kay Properties and Investments, they learned that we specialize in DST 1031 Exchanges and that we have access to a variety of DST properties from many DST sponsor companies throughout the industry.

DST vs. TIC: Delaware Statutory Trust vs. Tenant in Common –Which is Right for Your 1031 Exchange?

Investors considering a 1031 exchange often look at Delaware Statutory Trust and Tenant in Common Properties as a more passive, hands-off investment vehicle whereby they do not have responsibility for the day-to-day operations and management of a property. The question many investors have is which is the winner in the DST vs. TIC debate.

Delaware Statutory Trust Tax Treatment, Taxation, and Tax Returns: DST 1031 Exchange Market Insights and Thoughts

By: Dwight Kay When considering a Delaware Statutory Trust property for a 1031 exchange, investors and their CPAs must also consider the tax treatment of DST properties – How is a Delaware Statutory Trust taxed? This article gives a brief overview of the various Delaware Statutory Trust tax treatment and DST taxation topics that investors should understand and go over with their CPA and tax attorney prior to making any investment decisions. DSTs are considered … Read More

Case Study: When a DST property backup became a clear solution.

By: Jason Salmon, Senior Vice President and Managing Director of Real Estate Analytics – Kay Properties and Investments, LLC Based on our history and the hundreds of clients that we’ve worked with for their 1031 exchange replacement property—I believe that this case will be highly relevant and relatable to a lot of people. A real estate investor named Ted inquired with Kay Properties a few months prior to the sale of his investment property that … Read More

DST 1031 Exchange Example Case Study: Diversification Matters

By: Betty Friant, Senior Vice President Recently a 1031 Exchange client, who was already working with another registered representative on his Exchange, reached out to Kay Properties to receive a second opinion on his 1031 exchange DST selection. This client had started to invest the entire amount from the sale of his property into one single DST. After discussing with his wife how at Kay Properties we believe diversifying* among multiple DST offerings and sponsors … Read More

Delaware Statutory Trust Fees: Delaware Statutory Trust Market Thoughts and Insights

When an investor is considering a Delaware Statutory Trust, one of the items that should be reviewed is the upfront allotment of fees. This article gives a brief description of the upfront fees that Delaware Statutory Trust properties can contain. First, DST fees include real estate related fees such as escrow, title, appraisal, environmental report, property condition report, legal, closing costs, etc. These are fees that if an investor would likely to incur if they … Read More

12 Reasons Why We Like Florida Delaware Statutory Trusts

We recently brought to market, in cooperation with one of our joint-venture partners, an all-cash/debt-free commercial office property opportunity in Tampa, Florida. It is currently available to our accredited clients as a Delaware Statutory Trust (DST) 1031 exchange offering via Regulation D, Rule 506c. Here are 12 reasons why we like Tampa, FL: Tampa is the number-one city people moved to in 2016 according to Realtor.com Tampa is located in the state of Florida which … Read More

Delaware Statutory Trust Problems – 1031 Exchange Market Insights & Thoughts

By: Dwight Kay Many 1031 exchange investors researching Delaware Statutory Trust (DST) properties are looking to find out if the DST 1031 concept is “too good to be true”. What’s not to like about mailbox money from an institutional piece of real estate, that is prepackaged and easily closed on in 3-5 days? Well, understanding potential Delaware Statutory Trust problems and things that can go wrong is something that every investor must be aware of … Read More

Kay Properties Announces a Completed 1031 Exchange Delaware Statutory Trust (DST) Property in Chesapeake, VA

LOS ANGELES and CHESAPEAKE, Va., Oct. 09, 2017 (GLOBE NEWSWIRE) — Kay Properties today announced the successful closing of the Seacoast DST in Chesapeake, VA. The property was made available to accredited investors under Regulation D Rule 506c. The Seacoast DST was a 125,096 square foot industrial property located in Chesapeake, VA. The property was an all-cash/debt-free DST offering available for 1031 exchange and direct cash investors. Dwight Kay, Founder and CEO of Kay Properties … Read More

Kay Properties Closes Delaware Statutory Trust (DST) Property in Tampa/Riverview, FL

LOS ANGELES and TAMPA/RIVERVIEW, Fla., Oct. 12, 2017 (GLOBE NEWSWIRE) — Kay Properties has successfully completed the Interchange DST in Tampa/Riverview, FL. This DST property was made available to accredited investors under Regulation D Rule 506c. The interchange DST was a 60,000 square foot property in Tampa/Riverview, FL. The property was an all-cash/debt-free investment available for 1031 exchange and direct cash investors. Dwight Kay, Founder and CEO of Kay Properties commented, “the successful completion of … Read More

Delaware Statutory Trust Pros & Cons

Delaware Statutory Trust Pros & ConsBy Dwight Kay, Founder and CEO, Kay Properties and Investments Real estate investors love Delaware Statutory Trusts for their 1031 exchanges because they can provide individuals a unique opportunity to defer capital gains taxes, eliminate active management responsibilities, and achieve the potential for regular monthly cash distributions. However, the first step to using the DST 1031 exchange real estate investment strategy is to first understand the pros and cons of … Read More

DST 1031 Exchange Case Studies

Challenge: The client was looking for specialized and focused help in evaluating DST 1031 properties for her 1031 exchange. She had been introduced to a financial advisor that not only did not fully understand how 1031 exchanges and investment real estate work, but also only had two DST properties available. The client was then introduced by a family friend to Kay Properties and Investments, LLC. She was relieved to find a group that truly specialized … Read More

The Case for Class B Apartments. Class A Buyers Beware.

Overall, the Class B segment of the multifamily apartment market has outperformed the Class A segment in the past several years; and that trend is forecast to continue. While new supply is greatly affecting the Class A apartment market with rent concessions, it is not having a material effect on the class B sector where we are focused. Although we do like Class A apartments at the right price point and in certain unique circumstances … Read More

NNN 1031 Choice Implodes: DST Available for Identification in 1031 Exchange

Challenge: Clients of Kay Properties and Investments identified two whole properties and a number of DST (Delaware Statuary Trust) properties for their 1031 Tax Deferred Exchange using the 200% rule. The 200% rule allows an investor to identify up to 200% of the fair market value of the relinquished property instead of just choosing three properties. After the Identification Period expired, one of the whole properties the clients had under Letter of Intent was withdrawn … Read More

14 Reasons Why We Like Phoenix, AZ

1. Dominant Economy Greater Phoenix represents roughly 75% of the state’s economy Many Fortune 500 companies reside within the Phoenix area such as Boeing, Bank of America, Time Warner Telecom, IBM, and Intel Gross Metropolitan Product: $203.7 B 2. Expeditious Population Growth Arizona, Maricopa County and metro Phoenix were all top 10 in population numbers added in 2015 (bizjournals.com) 2% population growth rate within the last year (0.8% national average) (Phoenix Business Journal) 3. Impressive … Read More

Location, Location, Location: 8 Reasons Why We Like Las Vegas, NV

1. Business Friendly Environment Nevada is the 3rd friendliest state for business taxes in the nation, according to the Tax Foundation, and it has held that position since 2012 2. LOWEST TAXES IN THE COUNRTY Yes, you read that right… Las Vegas proudly boasts the lowest taxes in the nation thanks entirely to the huge taxable profits made by the casinos every year 3. “The Entertainment Capital of the World” Over 45 million tourist … Read More

15 Reasons to Invest in Walgreens!

In 2013 Walgreen bought Alliance Boots, a chain of pharmacies in the UK that also sold health and beauty products in 11 countries. This drastically increased Walgreens product offering, supply chain, and market capitalization in the pharmaceutical industry. Walgreens Boots Alliance ranked 35 on the Fortune 1000 list. Walgreens has 13,100 stores in over 11 countries, which makes it the largest retail pharmacy in the U.S. and Europe. Revenue during Walgreen’s fiscal year in 2015 … Read More