“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments By Dwight Kay, Founder & CEO Kay Properties & InvestmentsIn today’s complex real estate market, understanding the nuances of 721 UPREIT DST structures is essential for any investor. One of the critical features of these arrangements is that the REIT holds the option—but not the obligation—to purchase the DST’s property through … Read More

Due Diligence 101 on 721 Exchange UPREIT DST Investments

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments By Dwight Kay, Founder & CEO Kay Properties & InvestmentsIn recent years, non-traded and perpetual life REITs have emerged as attractive vehicles for real estate investors, especially within the 721 UPREIT DST structure. While these vehicles offer tax-deferred exchange benefits and diversified exposure to real estate, investors must scrutinize several key … Read More

Hypothetical Case Study: Tired of Encroaching Rent Control Regulations, Investor Turns to Kay Properties & Investments to Help Build a Diversified DST 1031 Exchange Strategy

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments *Diversification does not guarantee profits or protect against lossesClick to see detailed case study portfolioOverview:Meet Tom, a Seasoned Real Estate Investor Who’s Tired of Active Management and the Headaches of Increasing Rent Control Regulations Tom quickly recognized he needed to complete a 1031 exchange to help defer taxes and find a … Read More

721 Exchange UPREITs and Delaware Statutory Trust Offerings – Essential Items to Consider before Investing

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments By Dwight Kay, Founder & CEO Kay Properties & InvestmentsOver the years, the use of the 721 Exchange as a Delaware Statutory Trust exit strategy has become increasingly popular among investors for a number of reasons, including the ability to provide tax deferral benefits, the potential for portfolio diversification, the potential … Read More

Why Politics, Demographics, Pandemics, and Economics Are Forces That will Likely Ensure 1031 Exchanges and Delaware Statutory Trusts are Here to Stay

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments It doesn’t seem that long ago when the winds surrounding the commercial real estate industry were rustling with whispers of Joe Biden’s plans of repealing the current 1031 exchange laws and quashing alternative like-kind exchange vehicles such as Delaware Statutory Trusts. However, with Donald Trump’s successful re-election bid, policies like the … Read More

(Exclusive Aerial Video) A Closer Look at the Pharmacy Net Lease 65 DST in Downtown Encinitas, CA

By Dwight Kay, Founder and CEO of Kay Properties & Investments One of current Delaware Statutory Trust offerings available for 1031 exchange as well as direct cash investment, is the Pharmacy Net Lease 65 DST, a Regulation D Rule 506 (c) offering in downtown Encinitas, CA. 100% Debt-Free AcquisitionThe Pharmacy Net Lease 65 was purchased as an all-cash, 100% debt-free acquisition as a purposeful strategy to mitigate risk associated with potential lender foreclosure or cash … Read More

Top 4 FAQs on Delaware Statutory Trusts

Kay Properties has one of the most robust educational platforms in the country when it comes to educating investors on the potential pros and cons of Delaware Statutory Trust investments for 1031 exchanges. One of the most impactful of these educational efforts is our educational client dinners throughout the country where we get a chance to speak directly to investors regarding some of the challenges they face associated with active property management and to discuss … Read More

Mastering DST Properties with Dwight Kay

Kay Properties and Investments Book on Delaware Statutory Trust Properties Remains One of the Best Resources for 1031 Exchange Readers Interested in How DSTs Work Article Highlights: Why did Dwight Kay write a book on Delaware Statutory Trusts? The book talks about Delaware Statutory Trust pros and cons. More than 30,000 copies have been distributed to DST 1031 exchange investors. The book was written in a straight-forward, easy-to-read style. When Dwight Kay, founder and CEO … Read More

An Easy Guide to Delaware Statutory Trust Investing

Investors interested in Delaware Statutory Trust properties could benefit from a guide that clearly explains Delaware Statutory Trust properties for a 1031 exchange and provides valuable information on topics like: Key Highlights: What is a Delaware Statutory Trust? What is the history surrounding the Delaware Statutory Trust? What are the important dates that impacted the Delaware Statutory Trust? What are some of the benefits of the Delaware Statutory Trust? What are some of the risks … Read More

Delaware Statutory Trusts for Accredited Investors

By Dwight Kay, Founder and CEO, Kay Properties and Investments Key Takeaways: What is the definition of an Accredited Investor? Why does the Securities and Exchange Commission require some investors to be accredited? Do Delaware Statutory Trusts require Investors to be accredited? What is the history of investor accreditation? The combination of aging demographics, stock market volatility, and a desire to find an investment strategy that delivers passive income are all contributing to the growing … Read More

Why Real Estate Income Funds Have Distinct Benefits for Investors

By: Kay Properties and Investments, LLC The recent fluctuations in the United States stock market have many investors looking for more conservative and less volatile investments. On top of that, traditional investment instruments like stocks and bonds are similarly not looking very attractive because of their lackluster yield performances. Therefore, more and more investors are attracted to Real Estate Income Funds. While Kay Properties & Investments is best known for its expert-level knowledge of Delaware … Read More

How to Plan Your Delaware Statutory Trust to Remove the Stress of a 1031 Exchange

By: Matt McFarland, Senior Vice President, Kay Properties and Investments Any investor who is considering selling a piece of investment real estate will undoubtedly consider a 1031 Exchange. A 1031 Exchange refers to the IRS code that allows significant tax advantages for investors. How? When you sell an investment property and you have a profit, you normally are required to pay capital gains tax. A 1031 Exchange allows you to sell your investment real estate … Read More

Seven DST 1031 Exchange Terms Every Real Estate Investor Should Know

Kay Takeaways: Knowing key terms for a 1031 Exchange is important for investors What is the definition of “beneficial interest” and how does it relate to DST’s? What is a Tenant In Common Investment? Do you know what a Qualified Intermediary is? Becoming a serious 1031 Exchange real estate investor can involve a significant learning curve. For example, there are many investment terms that every investor shouldknow and understand in order to better understand the … Read More

The Importance of the Private Placement Memorandum (PPM) for Delaware Statutory Trust 1031 Exchange Investors

Key Takeaways: PPMs are part of all Delaware Statutory Trust Investments PPMs provide investors a full picture of the overall investment, including the potential risks PPMs include important information for investors including the DST trust agreement, summary of third-party reports, lease agreements, and most recent property appraisal. All Kay Properties Delaware Statutory Trust 1031 Exchange real estate investments must be accompanied by a unique Private Placement Memorandum (PPM) as part of its due diligence and … Read More

Consider These Potential DST 1031 Exit Strategy Options: Cash Out, 1031 Exchange or 721 Exchange

By Dwight Kay, Founder and CEO of Kay Properties and Investments One of the most important questions all real estate investors should ask themselves is, “What is my long-term strategy?” In the case of Delaware Statutory Trust (DST) investors, exit strategies come into play once the investment period has concluded, or gone “Full Cycle”. Full Cycle is a term used to describe DST property that has been sold on behalf of investors after a period … Read More

Why Real Estate Syndication Is Important for Delaware Statutory Trust 1031 Exchange Real Estate Investors

Key Takeaways: How does Delaware Statutory Trust Syndication benefit investors? Why Real Estate Syndication via a DST can potentially reduce risk for investors*? What is the Portfolio Optimization and Diversification Theory? How real estate syndication and DST investments can help investors access larger real estate assets? Delaware Statutory Trust 1031 exchanges have never been more popular, and one of the reasons behind this growth and investor appeal is the power and flexibility of real estate … Read More

Six Ways to Ensure Your 1031 Exchange is Successfully Completed

Whether you are an investor or a real estate broker, selling investment or business real estate can be an expensive venture unless you are prepared to conduct a 1031 exchange. Section 1031 of the federal tax code dictates that no gain or loss shall be recognized upon the sale of a real estate property held for business or investment purposes, as long as the seller purchases a replacement property of equal or greater value. This … Read More

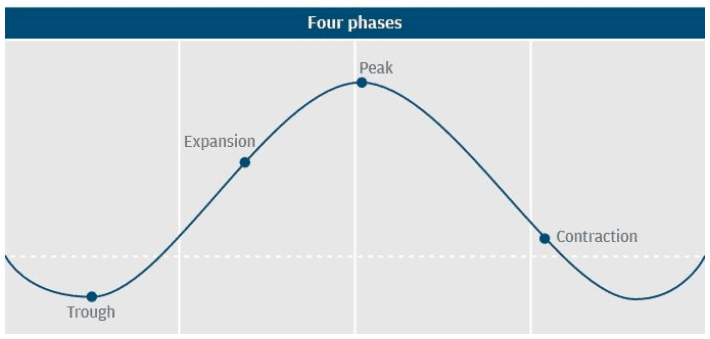

Investing Across Market Cycles and Delaware Statutory Trust Investments

Key Takeaways: What are the Four Stages of a Real Estate Cycle? What are some Current Macro Real Estate Trends Impacting Investment Real Estate? Why Should Delaware Statutory Trust Investors Be Aware of Current Real Estate Trends? One of the common topics that frequently pops up in investment conversations these days involves questions about what stage of the “real estate cycle” is the market currently in, and how does the current real estate market cycle … Read More

As seen in Forbes: The Ins and Out of Qualified Opportunity Zones

By Betty Friant, CCIM, Senior Vice President, Kay Properties & Investments It’s a great feeling when you sell some stock, a piece of real estate or the business you’ve poured your life into for a nice profit that puts a small fortune into your bank account. But then comes the tax bill to take a little bit of the bloom off that rose. It’s downright painful to hand your hard-earned money over to the government … Read More

As Seen on WealthManagement.com: How to Build a Post-Pandemic Real Estate Investment Portfolio

It’s a good time to assess real estate investment opportunities. By Dwight Kay, CEO & Founder, Kay Properties & Investments, LLC As we emerge, fortunately, from the pandemic, including the recent Delta variant surge, it’s a good time to assess real estate investment opportunities if you’re looking to reinvest proceeds in a 1031 exchange transaction or seeking to invest cash as part of a diversified* financial portfolio strategy. Here’s how you could build a post-pandemic … Read More

Select a DST 1031 Expert and Avoid the Four Stages of 1031 Exchange Grief

Key Takeaways: What are the four stages of 1031 grief? Why a DST 1031 expert can help investors avoid major stress with the sale of real estate. What are the most important things to look for when choosing a DST 1031 Advisory Firm? Participating in a 1031 exchange can be challenging for many investors, which is why finding an experienced and knowledgeable professional is critical for anyone thinking about participating in a 1031 exchange. For … Read More

Five Reasons Why Kay Properties Likes Houston – The Fourth Largest City in America and with Room to Grow

While Houston may have many nicknames that reflect the city’s culture (H-Town), climate (Bayou City), and chronology (Space City), Houston could also be called a “boom city” as it is also home to one of the fastest growing tech centers in the nation and to one of the most appealing markets for real estate investors. Why? Well, Houston has everything: the people, the diversity, the business climate, and a world-recognized center for energy, medicine, space, … Read More

Kay Properties President, Chay Lapin featured on Millionacres Podcast to explain Delaware Statutory Trust Investments

Taxes can loom large in our lives but one of the great things about investing in real estate in the first place is that there are structures that can help. One of them is DSTs, Delaware Statutory Trusts. If you’ve never heard of these or you or are curious to learn more this is the podcast for you. Deidre Woollard interviewed Chay Lapin of Kay Properties covering what investors need to know about DSTs and … Read More

As Seen on Kiplinger.com: Once the Pandemic Recedes, Where Will the Real Estate Investment Opportunities Be?

Some sectors of real estate are emerging from the pandemic in much better shape than others. Investors thinking about real estate need to know where to look. By: Dwight Kay, Founder & CEO of Kay Properties & Investments The COVID-19 pandemic has been kinder to some real estate asset classes than others. Proactive investors can take advantage of opportunities with the potential to build wealth and generate income from investment real estate, particularly tax-advantaged investments. … Read More

Thoughts on Senior Care

At Kay Properties we are very focused on reducing risk wherever possible. We all know that all real estate investments contain the risk of a loss of investment capital and that cash flow and appreciation are not guaranteed. One of the ways that we can help to reduce risk for our clients is by rejecting the higher risk asset classes in the DST marketplace; asset classes like student housing, oil and gas, hotels and senior … Read More

Six reasons to sell the income property you love…And how to avoid taxes when you do

Many investors recoil at the thought of selling a piece of investment property. And they usually have a good reason, whether it’s missing out on future appreciation, having to pay a massive tax bill, or some other factor. Yet it can often make good sense to sell your property, thanks to a real estate investment alternative that simplifies your life and lets you defer the taxes via a 1031 exchange. Let’s take a look at … Read More

Potential Pitfalls of NNN Properties and a Savvy Alternative

NNN properties seem like passive investments but actually require regular management. Overconcentration is a key risk when it comes to investing in NNN properties. DSTs (Delaware Statutory Trusts) provide an alternative way to invest in NNN properties. *Diversification* and true passivity are unique advantages of DST investments. Frequently investors are seeking out reduced management and or passive real estate investments. Real estate owners are simply tired of the three T’s (Tenants, Trash, Toilets) and are … Read More

The State of Multifamily Real Estate, 2021

The State of Multifamily Real Estate, 2021 By: Benjamin Sedaghat, Associate and Thomas Wall, Associate at Kay Properties and Investments, LLC The pandemic has taken its toll on the US economy over the past year rendering millions of Americans out of work. Renters across the country are not able to keep up with their rent payments due to pandemic related unemployment. “According to the Census Bureau’s Household Pulse Survey, as of late December, more than … Read More

Alternative Investments for High-Net-Worth Investors

By: The Kay Properties Team High-net-worth investors sometimes seek alternatives to investing in traditional asset classes like stocks and bonds. Real estate, in general, has historically been a good way for investors to diversify* their holdings with hard assets. Delaware Statutory Trusts (DSTs), Qualified Opportunity Zone Funds, and Real Estate Funds can provide investors with access to real estate investments that can potentially provide monthly distributions, zero management responsibility, diversification and tax benefits not always … Read More

As Seen on Kiplinger.com: 4 Ways to Invest in Real Estate for Monthly Income

Owning your own home can be a good investment for a number of reasons, but it’s not the same as owning income properties, which have the potential to produce cash income on a regular monthly basis. Consider the range of potential ways to invest in real estate for income. Please view Kiplinger article here. By Dwight Kay, CEO & Founder, Kay Properties & Investments, LLC Earlier this year, the homeownership rate in the U.S. hit … Read More

Generational Assets: Leveraging DSTs to Transfer Wealth

By Jason Salmon, Senior Vice President and the Kay Properties Team at Kay Properties & Investments, LLC Real estate has long been a popular asset used to build generational family wealth. One of the key tax advantages to passing real estate property to heirs is that those recipients benefit from a step-up in basis. That step-up is much like hitting the reset button on a property’s current market value. That step-up in value alone can … Read More

Five Steps to Construct a Diverse Real Estate Investment Portfolio

Dwight Kay Founder of Kay Properties recently published in National Real Estate Investor Magazine. Here are some guidelines on maximizing returns and minimizing risks when building your commercial real estate portfolio. Please view the article on NREI here. Millions of Americans invest in alternative assets, including real estate. It’s an important step to diversify* a portfolio with investments that don’t necessarily correlate with the stock or bond markets. Here are five tips to help construct a … Read More

Can I Cash-Out a Portion of my 1031 Exchange Proceeds? The Ins-and-Outs of A Partial 1031 Exchange

Many investors that come to Kay Properties are looking for a full tax deferment utilizing a like kind exchange. A full tax deferment under IRC Section 1031 consists of buying a replacement property for equal or greater value than that of your relinquished value of the property. For example, if an investor sells their property for a net sales price of $1,000,000 in order to have full tax deferment under Section 1031, the investor has … Read More

Good to Have a 1031 Exchange Backup When You Need One: Kay Properties Helps DST Investors Avoid a Potentially Significant Tax Consequence

By: Alex Madden, Vice President, Kay Properties and Investments, LLC Kay Properties and Investments is pleased to announce a completed exchange for an investor who did not originally intend to invest into Delaware Statutory Trust (DST) properties. Vice President Alex Madden explained: “After discussing the client’s background in real estate investing, he expressed his first choice was to continue with active management for a few more years before he began moving his substantial real estate … Read More

Questions to Ask Your 1031 Exchange Qualified Intermediary

By: Kay Properties & Investments When checking off the boxes for your 1031 exchange “to do” checklist, choosing a qualified intermediary should be on top of that list. The IRS requires exchangers to employ a qualified intermediary (aka “QI, “accommodator,” or “facilitator”) to receive the funds upon sale of the exchanger’s property. Section 1031 of the Department of the Treasury Regulations authorizes the QI to receive and hold the funds, advise on compliance matters, and … Read More

Three 1031 Exchange Alternatives

By: Jason Salmon, Senior Vice President; Managing Director of Real Estate Analytics, Kay Properties and Investments, LLC Are you considering a 1031 exchange? There’s no doubt that in cases of like-kind exchanges, the Section 1031 offers tax gains that may amount to a substantial figure. It helps explain the popularity of the exchange option in the U. S. However, in many cases, in order to take advantage of the reduced and deferred taxes, the 1031 … Read More

DST 1031 Exchange Investment Strategies: Why 1031 Exchange Diversification Matters

By: Orrin Barrow, Vice President, Kay Properties and Investments, LLC The Delaware statutory trust was invented so investors would have the ability to utilize their 1031 exchange proceeds to diversify* across different 1031 DST sponsor companies, asset classes, submarkets and investment strategies. We here at Kay Properties and Investments have access to a diversified DST 1031 marketplace platform (kpi1031.com) to be able to build well diversified DST portfolios for our clients who are currently in … Read More

The Other DST – Deferred Sales Trust: What You Should Know

By: Matt McFarland, Associate at Kay Properties & Investments, LLC Many times, when researching the Delaware Statutory Trust structure as a potential 1031 exchange option, investors will come across another DST—the Deferred Sales Trust. It can all be very confusing. The Delaware Statutory Trust is an accepted part of the Internal Revenue Code under Revenue Ruling 2004-86 and has provided investors the ability to defer their taxes upon sale of an appreciated piece of investment … Read More

5 Tips to Build a COVID-Proof Real Estate Investment Portfolio

By: Kay Properties and Investments, LLC So, you’ve decided to invest in income-producing real estate as a way to diversify* your investment portfolio so all your assets are not correlated to the stock market’s performance. Now how do you plan a real estate portfolio to build wealth and withstand a crisis? We’ve learned a great deal from analyzing the market through crises including 9/11, 2008-2009, and the current COVID-19 pandemic. There are no guarantees and … Read More

So Your 1031 Exchange Deadline Has Been Extended? Why Waiting Until the July Deadline Could Be a Bad Idea

Please view our story on National Real Estate Investor here. With so many exchanges facing the same deadline, there is very real potential for unintended consequences. As a result of the COVID-19 pandemic the IRS issued Notice 2020-23, which provided a multitude of tax extensions, including 1031 like-kind exchange deadlines for some investors. While the extensions were provided for good reason, there may be unintended consequences if eligible investors all wait to pull the trigger on … Read More

The Virus Economy: It Now May Be a Good Time to Diversify Real Estate Holdings

By Chay Lapin, Senior Vice President – Kay Properties and Investments The entire country is experiencing a national lockdown and businesses have been stopped in their tracks. This has caused many commercial and residential tenants to struggle with the ability to pay rent resulting in a very unknown and difficult time for landlords. According to the U.S. Department of Labor, over 20,500,000 people are unemployed as of May 8,2020. Also, many publications have noted that … Read More

Buyer Beware: Are Oil and Gas Investments a Good Idea

By: Matt McFarland, Associate at Kay Properties & Investments With any and every investment comes risk. Investors everywhere are continually trying to balance the risks of an investment against the potential rewards. As a national leader in DST 1031 Exchange and real estate investments, Kay Properties is constantly presented various investment opportunities to offer our clients. We do not and will not participate in an oil and gas investment, as the inherent risks greatly outweigh … Read More

Cash Investments in DSTs – An Alternative to Investing in the Stock Market

By: The Kay Properties Team Delaware Statutory Trusts are potentially a great investment vehicle for those accredited investors doing a 1031 exchange, but what some investors don’t realize, is that you can also invest in DSTs on a cash basis. Why invest cash in a DST? DSTs offer many benefits to those doing a 1031 exchange, for example, the ability to defer their capital gains from the sale of their investment real estate as well … Read More

Being Defensive Pays Off: Kay Properties’ Clients Avoid Potential Hospitality & Senior Care Crash and Burn – Why Avoiding Hospitality and Senior Care is the Kay Properties Way

By Alex Madden, Vice President at Kay Properties and Investments For many years Kay Properties has taken the position that we will not offer three asset classes to Investors because they carry too high of risk to investors equity: Hospitality, Senior Care, and Oil & Gas. While other groups have gleefully entered into some of these sectors searching for higher potential returns, Kay Properties has maintained the position that they are much too volatile, and … Read More

Acronyms to Know in the Investment World

By Betty Friant, Senior Vice President at Kay Properties & Investments and The Kay Properties Team Becoming a serious investor involves a significant learning curve. There are many acronyms used in the investment world that you will need to know and understand to find success as an investor. Here are some common acronyms to file away in your long-term memory. DST Delaware Statutory Trust or DST is an entity used to hold title to investment … Read More

Why Real Estate is a Powerful Estate Planning Tool

By Matthew McFarland, Associate at Kay Properties & Investments and The Kay Properties Team Real Estate has been and remains one of the most powerful estate planning tools. There are numerous reasons real estate is positioned to be one of the most tax-efficient investment tools that exist— here are just a few: 1) Step-up in Basis: To many investors and tax professionals, this is where the majority of the tax efficiency comes. A “step-up in … Read More

4 Reasons Estate Attorneys Utilize DSTs for Legacy Planning

By: The Kay Properties Team Advisors at Kay Properties & Investments have worked closely with Estate Attorney’s to assist with their client’s legacy planning. The Delaware Statutory Trust can offer many potential benefits to investors. Below are four reasons estate attorneys incorporate DSTs in their client’s estate planning. Everyone’s situation is unique. All investors should speak with their tax/legal advisor when conducting their own estate planning. 1. Potential tax benefits. According to the Internal Revenue Code … Read More

Qualified Opportunity Zone Funds – A Tax Efficient Investment Vehicle for Those Selling Appreciated Assets

By: Kay Properties & Investments What is a Qualified Opportunity Zone (QOZ)? A QOZs as described under the 2017 Tax Cuts and Jobs Act is a social program with the intent of redeveloping impoverished districts throughout the country by driving private capital to over 8,700 underserved communities and 35M Americans throughout by offering tax incentives to investors¹. What is a Qualified Opportunity Zone Fund (QOF)? A QOF is a legal entity (partnership or corporation) used … Read More

Phoenix, AZ – Market Overview

In the last five years, there are two markets that have had unprecedented growth in comparison to the rest of the country. Both have surpassed several cities on the rankings of “Largest U.S. City Population” held by the US Census Bureau and they now rank at the fourth and fifth largest city, respectively. Houston in on track to surpass Chicago as the third largest city in the country, and Phoenix is following right behind it. … Read More

- Page 1 of 2

- 1

- 2