“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments *Diversification does not guarantee profits or protect against lossesClick to see detailed case study portfolioOverview:Meet Tom, a Seasoned Real Estate Investor Who’s Tired of Active Management and the Headaches of Increasing Rent Control Regulations Tom quickly recognized he needed to complete a 1031 exchange to help defer taxes and find a … Read More

721 Exchange UPREITs and Delaware Statutory Trust Offerings – Essential Items to Consider before Investing

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments By Dwight Kay, Founder & CEO Kay Properties & InvestmentsOver the years, the use of the 721 Exchange as a Delaware Statutory Trust exit strategy has become increasingly popular among investors for a number of reasons, including the ability to provide tax deferral benefits, the potential for portfolio diversification, the potential … Read More

Why Politics, Demographics, Pandemics, and Economics Are Forces That will Likely Ensure 1031 Exchanges and Delaware Statutory Trusts are Here to Stay

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments It doesn’t seem that long ago when the winds surrounding the commercial real estate industry were rustling with whispers of Joe Biden’s plans of repealing the current 1031 exchange laws and quashing alternative like-kind exchange vehicles such as Delaware Statutory Trusts. However, with Donald Trump’s successful re-election bid, policies like the … Read More

Kay Properties Adds Dynamic “The Peanut Factory Lofts” – a High-Quality Multifamily Acquisition to Its Nationally Recognized Online Marketplace

(Los Angeles, CA) Kay Properties & Investments, a national leader in Delaware Statutory Trust equity placements and 1031 exchange investor education, announced it has included The Peanut Factory Lofts, a dynamic multifamily asset in historic downtown San Antonio, TX to its nationally recognized online marketplace located at www.kpi1031.com. According to Dwight Kay, CEO and Founder of Kay Properties, this unique asset was an all-cash acquisition and is considered a high-quality Delaware Statutory Trust for 1031 … Read More

Dwight Kay Provides Real Examples of Investors Who Used Kay Properties for Legacy and Estate Planning Purposes Regarding their Rental Property and Real Estate Investment Portfolios

By Dwight Kay, Founder & CEO Kay Properties & InvestmentsMore and more, our team of 1031 exchange DST experts at Kay Properties & Investments is being asked about legacy and estate planning. Every day we hear questions like: How are my children going to inherit my properties? What will the tax consequences be? How do we handle the potential for in-fighting or competing priorities amongst our heirs or kids? Preserving wealth across multiple generations requires … Read More

The 721 Exchange UPREIT Exit Strategy for Delaware Statutory Trust Investors Explained

One of the most important questions Delaware Statutory Trust real estate investors need to ask themselves is, “What is my long-term, exit strategy?” Most Delaware Statutory Trust (DST) investments are typically held for approximately 5-10 years (although it could be shorter or longer). After that, the DST investment will typically go “Full-Cycle”, a term used to describe a DST property that is purchased on behalf of investors and then after a period of time is … Read More

(Exclusive Aerial Video) A Closer Look at the Pharmacy Net Lease 65 DST in Downtown Encinitas, CA

By Dwight Kay, Founder and CEO of Kay Properties & Investments One of current Delaware Statutory Trust offerings available for 1031 exchange as well as direct cash investment, is the Pharmacy Net Lease 65 DST, a Regulation D Rule 506 (c) offering in downtown Encinitas, CA. 100% Debt-Free AcquisitionThe Pharmacy Net Lease 65 was purchased as an all-cash, 100% debt-free acquisition as a purposeful strategy to mitigate risk associated with potential lender foreclosure or cash … Read More

Why Kay Properties Stands Out as an Expert Delaware Statutory Trust Firm

The Delaware Statutory Trust (DST) investment strategy has become one of the most popular choices for accredited investors seeking replacement properties for their 1031 exchanges. Kay Properties is often considered the preferred choice for1031 exchange DST investors in this space who want an expert Delaware Statutory Trust firm. investment strategy has become one of the most popular choices for accredited investors seeking replacement properties for their 1031 exchanges. Kay Properties is often considered the preferred … Read More

Why Investors Choose Delaware Statutory Trust Properties vs. NNN Properties for 1031 Exchanges

By Dwight Kay, Founder and CEO of Kay Properties and Investments Over the years, I have seen many clients that started to purchase a NNN property for a 1031 exchange ultimately decide to invest in a Delaware Statutory Trust 1031 property instead. In many cases these clients are drawn to NNN properties because they think that is the only choice to achieve passive ownership of real estate but are concerned about placing such a large … Read More

A Comprehensive Guide and Video on Why Investors Should Consider Debt-Free Delaware Statutory Trust (DST) Properties

Learn eight specific and compelling issues 1031 exchange and Delaware Statutory Trust investors might not be aware of when it comes to risks associated with leverage. By Dwight Kay, Founder and CEO, Kay Properties and InvestmentsIn the world of 1031 exchanges and Delaware Statutory Trust investments, mitigating risks where possible is paramount. One strategy that has gained traction among savvy investors is the all-cash or debt-free Delaware Statutory Trust (DST). As the founder of Kay … Read More

Top 4 FAQs on Delaware Statutory Trusts

Kay Properties has one of the most robust educational platforms in the country when it comes to educating investors on the potential pros and cons of Delaware Statutory Trust investments for 1031 exchanges. One of the most impactful of these educational efforts is our educational client dinners throughout the country where we get a chance to speak directly to investors regarding some of the challenges they face associated with active property management and to discuss … Read More

Mastering DST Properties with Dwight Kay

Kay Properties and Investments Book on Delaware Statutory Trust Properties Remains One of the Best Resources for 1031 Exchange Readers Interested in How DSTs Work Article Highlights: Why did Dwight Kay write a book on Delaware Statutory Trusts? The book talks about Delaware Statutory Trust pros and cons. More than 30,000 copies have been distributed to DST 1031 exchange investors. The book was written in a straight-forward, easy-to-read style. When Dwight Kay, founder and CEO … Read More

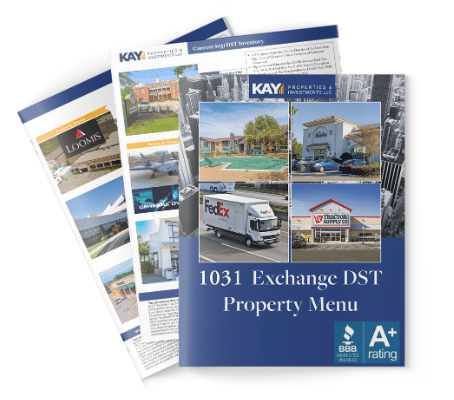

Why Investors Love the Kay Properties Online Marketplace for DST Investment Opportunities?

Many real estate investors looking for quality DST investment opportunities come to Kay Properties and Investments’ online 1031 exchange and real estate investment marketplace located at www.kpi1031.com. While most real estate investments made on the Kay Properties platform are for DST 1031 exchange replacement properties, the online marketplace is also drawing significant attention from direct cash investors as well. The reasons why investors choose to invest in DST properties as a purely discretionary cash investment … Read More

Why Delaware Statutory Trusts are a Great Resource for 1031 Exchanges

By Brent Wilson, Vice President, Kay Properties and Investments 1031 Exchange investors have probably noticed that over the past year, the Federal Reserve has been increasing interest rates to control the higher-than-normal rate of inflation. When this happens, one of the things that is triggered is that banks start to tighten their own lending standards because with a higher Fed Funds rate, it’s more expensive for banks to borrow from each other. This reality was … Read More

Why You Should Consider Using Both a 1031 Exchange and Delaware Statutory Trust to Defer Your Taxes

By: Jason Salmon, Executive Vice President, Managing Director, Kay Properties and InvestmentsA Look at the 1031 Exchange Basics: If you own investment real estate – whether a rental condo or home, apartment building, a commercial building, raw or vacant land or otherwise—you do not have to pay taxes when you sell the property. Uncle Sam has had section 1031 of the Internal Revenue Code in place since 1921. Also known as a 1031 exchange, this … Read More

How to Make Smart Real Estate Investment Decisions with a 1031 Exchange

By Dwight Kay, Founder and CEO, Kay Properties and Investments If you are a real estate investor, the 1031 Exchange is potentially one of the most powerful wealth-building strategies you have at your disposal. Sometimes called a tax-deferred exchange or like-kind exchange, the 1031 Exchange is a provision outlined in the Internal Revenue Code (Section 1031), which outlines how real estate investors can defer capital gains taxes on the sale of investment properties by reinvesting … Read More

A 1031 Exchange Expert’s Advice on Investing in DSTs

By Orrin Barrow, Senior Vice President, Kay Properties and InvestmentsIn the world of Delaware Statutory Trust investments, the position of Senior Vice President plays an important link between the client, the investment real estate asset, and the sponsor company who is presenting potential offerings. Over the course of the past several years as a Senior Vice President with Kay Properties and Investments, I have worked with hundreds of clients on their 1031 Exchanges and Delaware … Read More

History of DSTs and Current Marketplace Conditions

Join our Kay Properties Delaware Statutory Trust experts, Brent Wilson, Vice President and Alex Madden, Senior Vice President as they dive into the ins and outs of the Delaware Statutory Trust historical and current market conditions. The Delaware Statutory Trust has had a fascinating history for real estate investors dating all the way back to the 1970’s. How are investors using the Delaware Statutory Trust in today’s economic environment?Listen to this fascinating look at how the … Read More

An Easy Guide to Delaware Statutory Trust Investing

Investors interested in Delaware Statutory Trust properties could benefit from a guide that clearly explains Delaware Statutory Trust properties for a 1031 exchange and provides valuable information on topics like: Key Highlights: What is a Delaware Statutory Trust? What is the history surrounding the Delaware Statutory Trust? What are the important dates that impacted the Delaware Statutory Trust? What are some of the benefits of the Delaware Statutory Trust? What are some of the risks … Read More

Debt Free Net Lease 55 DST

Delaware Statutory Trust 1031 Current Offering Net Lease Distribution 55 DST Recently, Dwight Kay, founder and CEO of Kay Properties, sat down to discuss in detail some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace at www.kpi1031.com for accredited investors for their 1031 exchange or direct cash investments. These DST 1031 properties are just a handful of current offerings from approximately 20-40 different DST … Read More

Delaware Statutory Trusts: Triple Net Lease Properties

Join a couple of our Kay Properties Delaware Statutory Trust experts Betty Friant, Executive Vice President and Matt McFarland, Senior Vice President as they unpack the nuances of triple net lease properties. Triple net real estate investment properties are a popular choice for 1031 exchanges. Kay Properties Executive Vice President and Managing Director Betty Friant and Senior Vice President Matt McFarland take a closer look at NNN properties, and how they fit into the Delaware … Read More

Delaware Statutory Trusts FAQ: Frequently Asked Questions on DSTs

By Dwight Kay, Founder and CEO, Kay Properties and Investments Forward: As one of the nation’s leading expert real estate investment firms specializing in Delaware Statutory Trust investments, Kay Properties is regularly asked about the nuances and strategies surrounding Delaware Statutory Trust investments for 1031 exchanges or direct cash investments. Recently, I sat down to discuss some of Frequently Asked Questions investors ask regarding Delaware Statutory Trusts and 1031 exchanges. I recorded and transcribed this … Read More

Delaware Statutory Trusts for Accredited Investors

By Dwight Kay, Founder and CEO, Kay Properties and Investments Key Takeaways: What is the definition of an Accredited Investor? Why does the Securities and Exchange Commission require some investors to be accredited? Do Delaware Statutory Trusts require Investors to be accredited? What is the history of investor accreditation? The combination of aging demographics, stock market volatility, and a desire to find an investment strategy that delivers passive income are all contributing to the growing … Read More

DST Properties and 1031 Exchange Real Estate Investment Options

Recently, Kay Properties founder and CEO, Dwight Kay, sat down to discuss some of the DST real estate properties his firm recently had available for accredited investors. These properties are now fully subscribed, however they represent good examples of DST properties that are available on the kpi1031.com marketplace, and examples for 1031 exchange real estate options. The interview was recorded and transcribed so investors can have easy access and use it as a reference for … Read More

Delaware Statutory Trust Investor Reviews and Complaints

Interested in learning more about Delaware Statutory Trust 1031 investments? Make sure to do a thorough job of researching Delaware Statutory Trusts prior to investing in a DST real estate offering, including reviewing client reviews and testimonials, reading published materials, and understanding potential complaints investors may have with Delaware Statutory Trust investments. Please note that testimonials may not be representative of the experience of other clients. Past performance does not guarantee or indicate the likelihood … Read More

Why Real Estate Income Funds Have Distinct Benefits for Investors

By: Kay Properties and Investments, LLC The recent fluctuations in the United States stock market have many investors looking for more conservative and less volatile investments. On top of that, traditional investment instruments like stocks and bonds are similarly not looking very attractive because of their lackluster yield performances. Therefore, more and more investors are attracted to Real Estate Income Funds. While Kay Properties & Investments is best known for its expert-level knowledge of Delaware … Read More

Kay Properties Headlines Panel on Delaware Statutory Trusts and Why So Many Investors are Interested in Them

Kay Properties & Investments team of Delaware Statutory Trust 1031 Exchange experts Chay Lapin, President, Betty Friant CCIM Senior Vice President, and Jason Salmon, Senior Vice President and Managing Director of Real Estate Analytics assembled to discuss why more and more real estate investors are selling their investment properties and turning to DST 1031 Exchange investments. The presentation was part of “Wealth Management Real Estate’s Guide to Investing in CRE: Second Quarter Review” targeting high … Read More

10 Reasons We Like FedEx as a Tenant for DST 1031 Exchange Investments in 2022

By Dwight Kay, Founder & CEO of Kay Properties & Investments Kay Properties & Investments is a fully integrated real estate investment firm that is an expert at sourcing deals, closing acquisitions, and performing necessary due diligence/analysis on Delaware Statutory Trust properties for 1031 exchanges and direct-cash investments. While no one has a crystal ball and can predict the performance of any real estate asset, we are encouraged by one corporation that leases thousands of … Read More

Consider These Potential DST 1031 Exit Strategy Options: Cash Out, 1031 Exchange or 721 Exchange

By Dwight Kay, Founder and CEO of Kay Properties and Investments One of the most important questions all real estate investors should ask themselves is, “What is my long-term strategy?” In the case of Delaware Statutory Trust (DST) investors, exit strategies come into play once the investment period has concluded, or gone “Full Cycle”. Full Cycle is a term used to describe DST property that has been sold on behalf of investors after a period … Read More

Kay Properties & Investments Team of 1031 Exchange Experts Lead Bisnow Webinar on “Why Investors Choose DST Properties”

Presentation covers the top three reasons investment owners are selling their rental properties and looking for alternative investment strategies like Delaware Statutory Trust 1031 Exchanges Recently, Kay Properties & Investments 1031 Exchange experts Chay Lapin, President, and Orrin Barrow and Matt McFarland, Vice Presidents, recently participated in a Bisnow webinar where they discussed some of the most common reasons investment property owners are selling their investment real estate, and why Delaware Statutory Trust 1031 Exchanges … Read More

Custom Kay Properties DST Offering Goes Full Cycle on Behalf of Investors

One of Kay Properties Custom DST offerings located in Greenville, SC has gone full-cycle delivering an annualized return of 12.60%* after providing uninterrupted monthly distributions throughout the COVID-19 Pandemic (Torrance, CA December 21, 2021) Kay Properties & Investments, a national DST investment firm, announced another one of its debt-free DST investments has gone full cycle to deliver successful returns on behalf of investors. According to Dwight Kay, CEO & Founder of Kay Properties & Investments, … Read More

Kay Properties is Pleased to Announce Another Successful Return for Investors in a Custom, Debt-Free DST That Goes Full Cycle

Kay Properties announced another DST offering exclusively through Kay has gone full cycle to post solid returns for investors as the Delaware Statutory Trust offering in Tacoma, WA has sold for $9.9 million Key Properties, the nation’s leading Delaware Statutory Trust 1031 advisory specialist firm,had successfully brought one of its custom debt-free DST investments full cycle on behalf of a group of accredited investors. “Full Cycle” is the name used to describe a Delaware Statutory … Read More

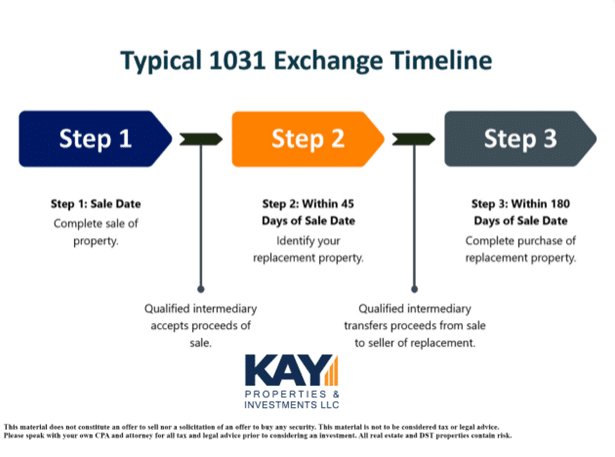

Six Ways to Ensure Your 1031 Exchange is Successfully Completed

Whether you are an investor or a real estate broker, selling investment or business real estate can be an expensive venture unless you are prepared to conduct a 1031 exchange. Section 1031 of the federal tax code dictates that no gain or loss shall be recognized upon the sale of a real estate property held for business or investment purposes, as long as the seller purchases a replacement property of equal or greater value. This … Read More

Executive Women in Business: Betty Friant

Recently, Betty Friant, CCIM and Senior Vice President with Kay Properties was interviewed by the Mid-Atlantic Real Estate Journal as one of its featured Executive Women in Business. Below is a summary of their interview with Betty. Name: Betty Friant Title: Senior Vice President Company/firm: Kay Properties & Investments Years with company/firm: 5 Years Years in field: 29 Years Real estate organizations / affiliations: CCIM, FINRA licenses Series 22 and 63. Tell us how and when you … Read More

Kay Properties President, Chay Lapin featured on Millionacres Podcast to explain Delaware Statutory Trust Investments

Taxes can loom large in our lives but one of the great things about investing in real estate in the first place is that there are structures that can help. One of them is DSTs, Delaware Statutory Trusts. If you’ve never heard of these or you or are curious to learn more this is the podcast for you. Deidre Woollard interviewed Chay Lapin of Kay Properties covering what investors need to know about DSTs and … Read More

Kay Properties Helps Place over $130M in Delaware Statutory Trust 1031 Exchange Investments For Family-Owned Real Estate Firm

Kay Properties is pleased to announce the completion of a three-phased 1031 exchange project resulting in an investment into over $130M of Delaware Statutory Trust (DST) properties. Over the course of multiple months, Kay Properties President, Chay Lapin, and Vice President, Steve Haskell, helped a family-owned real estate firm navigate three complex 1031 exchanges into a highly diversified* portfolio of DST properties. In the summer of 2020, the family-owned real estate firm began liquidating their … Read More

As seen on WealthManagement.com: Real Estate DSTs — A Haven in a 1031 Tax-Change Storm?

By Chay Lapin, President of Kay Properties & Investments, LLC In the face of the tax policy uncertainty, the question is how to think about current real estate investments and future investment plans. Washington-watchers including many of us in the real estate industry are waiting to see if and how federal policymakers change the tax treatment of capital gains and 1031 like-kind exchanges this year. The capital gains tax rate affects the flow of capital … Read More

Custom Kay Properties Delaware Statutory Trust Offering Goes Full Cycle

Kay Properties and Investments, LLC today announced that one of their custom Kay Properties Delaware Statutory Trust offerings successfully went full cycle on behalf of multiple 1031 exchange and direct cash investors. The DST investment that was sold was the Maple Springs Apartments in Richmond, VA which was a 268-unit multifamily community. For those investors that closed simultaneously on the DST investment the same day that the property was purchased, the total returns were approximately … Read More

Kay Properties and Investments Successfully Completes a $13.68M Exchange on Behalf of Midwest Family

By Matt McFarland, Vice President, and Thomas Wall, Associate, Kay Properties & Investments Kay Properties announces the completion of a 1031 DST exchange for a family that has owned and operated various businesses and real estate for many years. The group was excited to move away from active, hands-on management into a more passive, diversified* investment vehicle while taking advantage of the tax deferral offered through the 1031 exchange. They utilized the Kay Properties 1031 … Read More

Kay Properties Helps Family Complete $36 Million 1031 Exchange Amid COVID Pandemic

By: Kay Properties and Investments, LLC Kay Properties is proud to announce the successful completion of a family’s 36-million-dollar 1031 exchange diversified* into 15 Delaware Statutory Trusts. Chay Lapin commented, “At Kay Properties we have specialized in providing a far higher level of DST investing services than found at typical providers of DSTs. We specialize in DST investments thereby allowing us to provide full-service resources for our clients as they are going through their 1031 … Read More

Kay Properties Custom 1031 Exchange DST Investment Offering Goes Full Cycle on Behalf of 1031 Exchange Investors

View Press Release here. Kay Properties and Investments today announced that one of their custom 1031 exchange Delaware Statutory Trust – DST offerings has gone full cycle and was sold on behalf of investors. The offering was a multi-tenant office property located in the Tampa, FL MSA and was made available exclusively to Kay Properties clients in 2017. The offering generated a total return of 131.42% for the 1031 exchange and direct cash investors*. This … Read More

Using 1031 Exchange Delaware Statutory Trust Properties to Give Back – How a Kay Properties Client Gave Back

Please view press release here. Real Estate investors come in all types and many want to invest in a way that aligns with their values. Alex Madden, Vice President with Kay Properties and Investments explained: “When one of our Clients reached out and explained she wanted to invest in 1031 exchange Real Estate which offered a potential ‘Social Good’ Kay Properties and Investments leapt at the opportunity to help. We helped evaluate properties that provided … Read More

Kay Properties and Investments Helps Clients Complete a $4.4M 1031 Exchange

Kay Properties is proud to announce the successful completion of a 1031 exchange, in which DSTs were used in conjunction with non-DST real estate. The clients, two brothers who own and operate farmland in the Midwest, combined the purchase of farm properties with DST real estate to “replace” the necessary real estate value in their exchange to be able to take advantage of a full tax deferral. They utilized the Kay Properties 1031 DST marketplace … Read More

Longtime Delaware Statutory Trust Investors Choose Kay Properties Over Others for Their 1031 Exchange

Please view Yahoo Finance press release here. Many Clients like to work with Kay Properties for the access to the 1031 DST Marketplace available at www.kpi1031.com, others like it because of the depth of real estate and DST 1031 industry knowledge Kay Properties is able to bring to the table, while still others value the extensive due diligence provided by the Kay Properties team of analysts – these Clients saw that immediately. Alex Madden, Vice … Read More

How COVID-19 Has Affected Retail Real Estate

By: The Kay Properties Team Certain segments of the retail sector have been particularly hit hard by the lockdown orders instituted because of covid-19, for example clothing and home goods. Other retailers, like grocers and drug stores have outperformed, having been determined essential and where able to remain open. And although more States are now reopening their economies to “non-essential” businesses, some areas of retail will still nevertheless not recover fully and may see a … Read More

New York Times with Alex Madden

Kay Properties was featured in an article in the New York Times on 1031 exchanges. Our very own Alex Madden, Vice President with Kay Properties and former Army Ranger, was interviewed for the story. Please view our story on New York Times here.

The Story Behind Kay Properties & Investments DST Platform

Dwight Kay built Kay Properties and Investments with the vision of reducing concentration risk for his clients by providing investors a broad menu of DST opportunities available for their 1031 exchanges and cash investments. He wanted to ensure that his clients were not putting their hard-earned nest eggs in one single basket. Instead Dwight sought to avoid concentration risk by providing investors with the options of spreading their equity over many properties, geographic locations, tenants, … Read More

Five Interesting Facts about Delaware Statutory Trust Investments

By Alex Madden, Vice President with Kay Properties and Investments There is a lot to read and learn about DST or Delaware Statutory Trust investments and 1031 exchanges. First let’s begin with the basics. What is a DST 1031 Property? A DST is an entity with which investors can hold title to investment real estate. A structured DST property qualifies as like kind exchange property for a 1031 exchange. But there are many more facts … Read More

- Page 1 of 2

- 1

- 2