By Dwight Kay, Founder and CEO of Kay Properties and Investments

One of the most important questions all real estate investors should ask themselves is, “What is my long-term strategy?” In the case of Delaware Statutory Trust (DST) investors, exit strategies come into play once the investment period has concluded, or gone “Full Cycle”. Full Cycle is a term used to describe DST property that has been sold on behalf of investors after a period of time. A good example of a Kay Properties DST investment that went full-cycle is the Alexander Pointe Multifamily DST in Orange Park, FL.

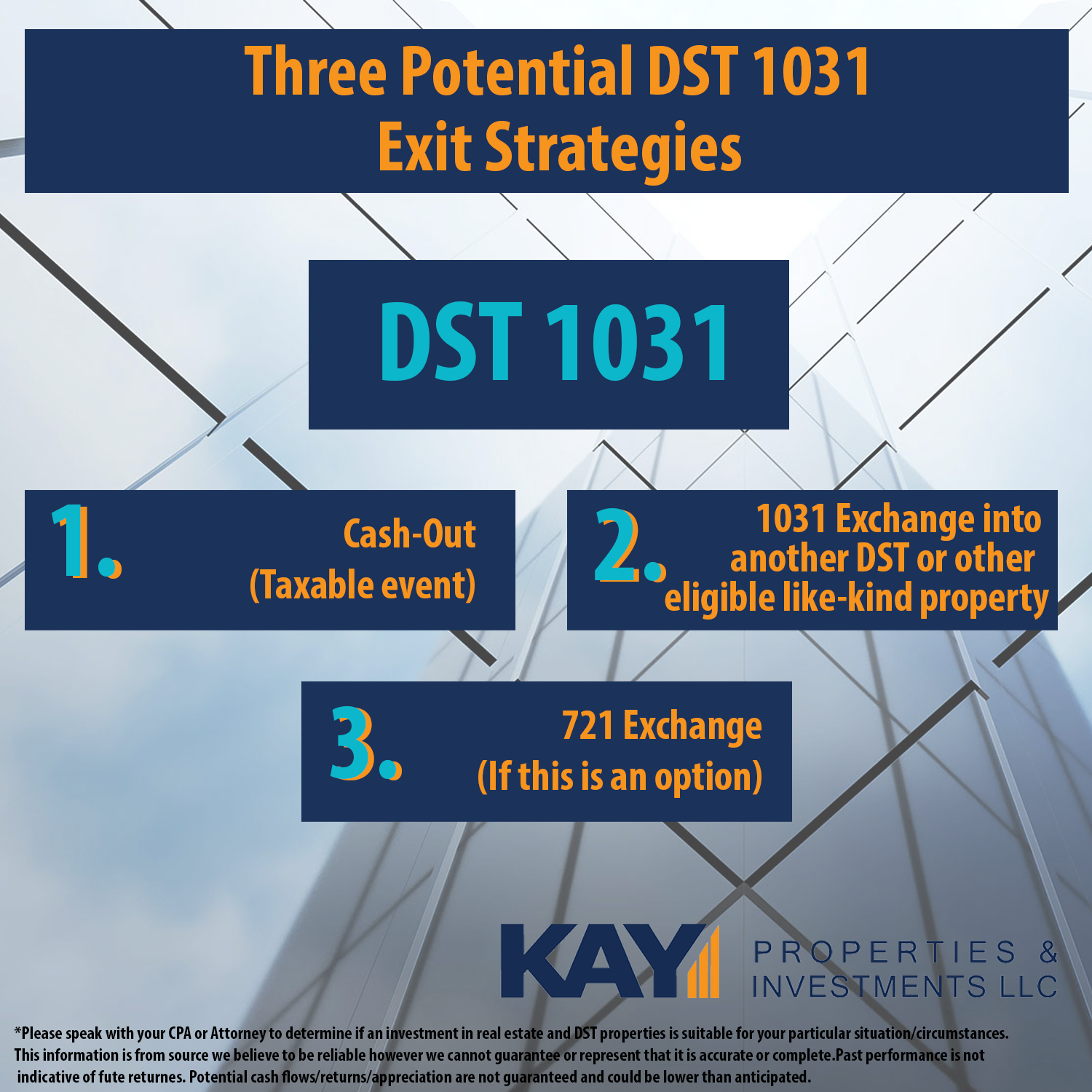

When a DST 1031 investment goes full-cycle, investors need to evaluate the entire spectrum of options available to them, including:

- Taking cash and triggering a tax event

- Complete a 1031 Exchange into another Delaware Statutory Trust offering or other eligible like-kind property

- 721 Exchange (If it is an option)

Click to Enlarge

Providing Investors Options for Their DST 1031 Exit Strategies

Kay Properties has helped thousands of clients invest in more than $30-billion of DST investments since its founding, so it understands how important exit strategies are for investors. As a result, Kay Properties makes it a point to explain exit strategies up front and in detail to allow each client to fully understand the business plan for each DST investment.

Kay Properties encourages investors to understand the full business plan and risk factors for each DST investment so investors can decide for themselves what offerings and corresponding exit strategies are appropriate based on their own individual circumstances. Kay Properties also encourages all investors to consult their tax attorney and certified public accountant prior to making any investment decisions.

For a listing of 1031 Exchange like-kind properties, go here.

The Three Most Common Exit Strategies for Investors

That being said, let’s look at some common exit strategies for DSTs. Each of the below options have potential advantages and disadvantages for investors, so each investor is encouraged to speak with a Kay Properties team member for details regarding which strategy may be the right fit for them.

Option One: Cashing Out

Because of tax consequences, this is usually the least appealing option for 1031 exchange investors. However, there are times when investors opt to not do a 1031 exchange and simply cash out, deciding to pay the associated tax liabilities that can quickly add up; Federal Capital Gains (15-20%), State Capital Gains (0-11.3% depending on the state he/she lives in), Depreciation Recapture Tax (25%) and the Medicare Surtax (3.8%) will all be due upon sale. This final tax bill for many investors may be very large, convincing many investors to seriously consider potential tax-deferral via another 1031 exchange into DST investments.

Option Two: 1031 Exchange.

A 1031 exchange (also known as a like-kind exchange) is the most popular and therefore most familiar exit strategy for investors following a DST investment full-cycle event. Because section 1031 defers taxes that would otherwise be recognized in a sale without a 1031 exchange, many real estate investors continue to exchange, and continue the deferral by exchanging their DST investments over and over. In this way, investors enter a series of exchanges, sometimes completed over decades. This is commonly known as a “swap ‘till you drop” strategy. This is considered by many to be an effective strategy for building real estate wealth over time and creating an estate planning tool.

Option Three: 721 Exchange Option

Another potential tax-deferral tool that is lesser known by even experienced investors is called a 721 exchange. The IRC Section 721 offers investors the potential for tax-deferred exchange when a Real Estate Investment Trust (REIT) acquires their property.Here’s how it works for owners of DSTs: After an investor invests in a Delaware Statutory Trust property, and the property goes full cycle, investors may have the ability to utilize a 721 exchange if a REIT purchases the DST real estate. In some cases, this could be mandatory and in other cases it could be an option. Instead of owning shares of the REIT in the exchange (which would be taxable), investors receive Operating Partnership (OP) units. This is all done on a tax-deferred basis through the 721 exchange.

The main caveat to the Section 721 exchange is that once an investor proceeds with the exchange, he loses the ability to continue 1031 exchanging and deferring taxes. He now only has the option to convert his Operating Partnership units to REIT shares and pay his taxes—if investors have the option for liquidity from that REIT.

Which of these 1031 exchange alternatives is best? Every case is specific, so it’s best to consult a Kay Properties licensed team member who can recommend the appropriate 1031 exchange options based on the investor’s unique situation, goals, risk tolerances and objectives. Contact us at 1-(855) 899-4597 or info@kpi1031.com for expert guidance.