By Dwight Kay, Founder and CEO, Kay Properties and Investments

If you are a real estate investor, the 1031 Exchange is potentially one of the most powerful wealth-building strategies you have at your disposal. Sometimes called a tax-deferred exchange or like-kind exchange, the 1031 Exchange is a provision outlined in the Internal Revenue Code (Section 1031), which outlines how real estate investors can defer capital gains taxes on the sale of investment properties by reinvesting the proceeds into another "like-kind" property. In order to successfully complete a 1031 Exchange, real estate investors must follow very specific rules.

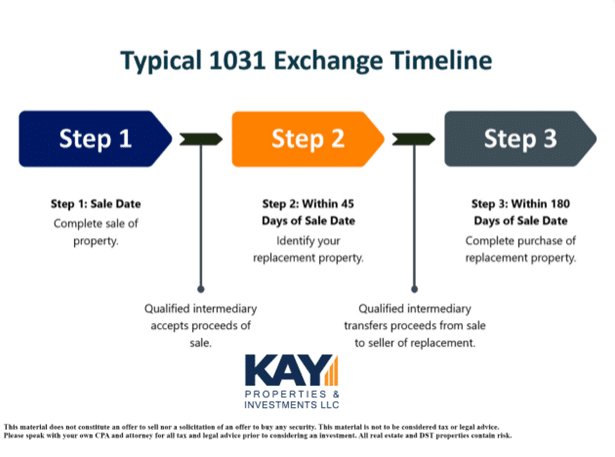

Here’s a quick summary of the 1031 Exchange rules investors should keep in mind when considering selling a piece of investment property:

- The entire 1031 Exchange process must be completed within 180 days

- Day 1 – Sell your property; proceeds are escrowed with a Qualified Intermediary (QI)

- Day 45 – Identify a property(s); you must notify your QI of the identified property(s)

- Day 180 – Close on the new property; you must close within 180 days after the first sale

- Maintain an equal or greater amount of equity in the replacement property

- Maintain an equal or greater amount of debt in the replacement property

Strategy Number One: 1031 Exchange into Like-Kind Properties That You Own and Manage Yourself

Traditionally, this strategy is what most people think of when considering a 1031 exchange, which is simply 1031 exchanging into more rental properties, multifamily buildings, commercial properties, etc that you will own and actively manage on your own. In this 1031 exchange strategy, you can trade up and enter potentially higher-performing investment real estate assets such as going from four to eight units or 16 to 32 or 50 units, or from a small office building into a self-storage facility or medical office building.Potential Problems with Strategy 1031 Exchange Strategy Number One:

However, one of the problems with this strategy is that you're still going to have to operate and manage that property on your own and be dealing with the famous “Three Ts’” of being a landlord: Tenants, Toilets, and Trash. Using this 1031 exchange strategy means receiving those calls at night and on the weekends when your tenant is demanding your attention. Of course, you could hire a property manager, but then you're going to have to manage that property manager and make sure they're doing their job, which can be just as much work as managing the property on your own.Another problem with this strategy is the potential for over-concentrating your exposure to risk. Investors that do a 1031 exchange into more commercial or multifamily assets on their own might be over-concentrating a large amount of their net worth into a single property in a single asset type or a single geographic location. While it’s important to note that diversification doesn't guarantee profits or protection from losses, it is something that investors should be cognizant of when considering this 1031 exchange strategy.

1031 Exchange Strategy Number Two: 1031 Exchanging Into a NNN Asset

Now the second common strategy for 1031 exchange investors is a more passive investment option, involving 1031 exchanging into a triple net lease or NNN property. So this is where you would 1031 exchange out of for example, a 15-unit apartment building and 1031 exchange into a building that's occupied or leased by a company like McDonald's or Starbucks or maybe Amazon or FedEx or Chipotle on a long-term basis, typically anywhere from 5, 10, 15 to 20 years. These companies, as long as they are solvent, will potentially be paying you, the landlord, rent every single month.Potential Problems with 1031 Exchange Strategy Number Two:

However, there are also potential problems with this type of 1031 exchange strategy as well. Specifically, while many people think that NNN properties are completely hands-off assets and 100% passive investments, they're really not. For example, many NNN landlords face potential issues with reimbursements. Let’s say one of these tenants is responsible, per the lease agreement, for paying the property taxes, insurance, and other various maintenance costs. However, in many cases, the lease is written so that you, the landlord, pay the property taxes or the insurance premiums and then submit it to the tenant for reimbursement. Oftentimes, these tenants are large Fortune 500 companies, and their staff and processes are always shifting and moving. For example, let’s say you pay the property taxes on your building, and submit it to the tenant for reimbursement, and a month goes by, three months goes by, six months goes by, you're still not reimbursed for that property tax amount.Even though the tenant is ultimately liable for that property tax payment, sometimes they are terribly slow at honoring those terms of the lease, or maybe they are such a behemoth of a company that it just takes a really long time due to corporate red tape and approval processes mixed with staff turnover which is often found at these large companies.

Another example is if the parking lot needs to be repaired which the tenant is responsible for per the lease but you as the landlord must perform the work and submit for reimbursement. You, as landlord and owner of the property, are still going to be responsible for tracking down those tenants for reimbursements, inspecting the property, and having to fix the parking lot and other items on the lease. Needless to say, this situation is far from a passive investment, and unfortunately, a lot of investors go into this type of 1031 exchange thinking its totally hands-off, when in reality it’s just not.

Finally, another issue with triple net properties is the potential for over-concentration of risk. Let’s say an investor has a net worth of $4 million, and they’re selling their 10-unit apartment building and doing a 1031 exchange into a NNN with McDonald's or Starbucks, or Burger King as the tenant. That 1031 exchange investment now represents half of their net worth, which translates to over-concentrating their investment into one property with one tenant in one location. To make matters worse, one of the horror stories with triple net properties is if at the end of the lease term, the tenant decides to vacate the building. Now you as the owner have to go out and re-tenant that building if you're lucky enough to find another tenant that wants that space. Then you are going to have to pay out tenant improvement allowances, leasing commissions, and so on. The whole process can be costly. Add to this situation that your previous national tenant was paying $20 a square foot and now the market might be $9 a square foot, or ostensibly half of the rent they were paying cutting your potential monthly cash flow in half.

1031 Exchange Strategy Number Three: Delaware Statutory Trust

Strategy number three is what our firm, Kay Properties and Investments, specializes in, and that’s helping investors 1031 exchange into a Delaware Statutory Trust, also known as a DST investment. A DST is an entity used to take title to real estate or hold title to real estate that’s been blessed by the IRS through revenue ruling 2004- 86 as a like-kind vehicle for 1031 exchange.For example, you can sell your 20 units or your small medical office building, or warehouse, whatever it is that you're selling, and 1031 exchange into a DST. Delaware Statutory Trust real estate assets can be multifamily apartments, triple net lease properties, self-storage, medical buildings or other real estate asset classes.

One of the reasons Delaware Statutory Trust investments are so popular for 1031 exchanges is that they are truly passive investments. Unlike the NNN where the landlord is still responsible for chasing down the tenant and getting them to honor the terms of their lease, with DST assets, there is a sponsor company that manages the investment for the investor. The sponsor company typically has an entire team of asset managers, attorneys, and accountants to manage the DST asset and manage the day-to-day headaches in terms of working with the tenants, working with the buildings, and all the items that investors used to have to do. Now they don't have to anymore because the DST sponsor company handles it.

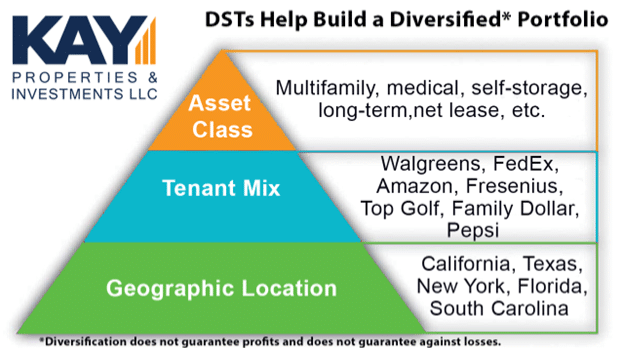

Another reason why so many investors are using 1031 exchanges into Delaware Statutory Trust properties is that the DST structure allows investors to become truly diversified*.

How do DST investments help create diversification? Let’s say you sold a building and netted from the sale $1 million dollars of equity, and instead of buying one triple net property for $2.5 million which would require you to use leverage, you decided to invest in DSTs as they allow you to take that $1 million dollars of equity and invest into five different DSTs in $200,000 increments, opening the potential of more exposure to different asset classes. So, you might invest in multifamily, medical net-lease and net-lease industrial with tenants like FedEx or Amazon or UPS. In this way, DSTs help investors build a truly diversified portfolio based on diversification amongst DST sponsor companies, asset classes, locations, amongst tenants. Again, diversification does not guarantee you are going to have gain or any profit, and there's no guarantee that you're going to be protected from losses. We always encourage clients to read the Private Placement Memorandum (PPM) and review the business plan and the risk factors so that you are fully aware of if the DST investment is a good fit for your particular situation. But at the end of the day, being able to become truly diversified is something that a lot of investors are really keen on, especially in today's volatile environment in 2023.

Kay Properties is here to help investors with their questions on 1031 exchanges and Delaware Statutory Trust investments and is available to answer questions or calls with your CPAs, attorneys, family members, etc.

If you'd like to get a free book on DST investments for 1031 Exchange investors, as well as see our current inventory of DST offerings from more than 25 different DST sponsor companies, please register for free at kpi1031.com or feel free to call 1-855-899-4597.