Get Access To 1031 Exchange Delaware Statutory Trust (DST) Property Listings For Free!

Sign up now for free access!

Custom DST Property Access

Our clients have the ability to participate in private, exclusively available, custom DST offerings as well as those presented by over 25 DST sponsor companies – with the exception of those that fail our due diligence process.

As Seen On

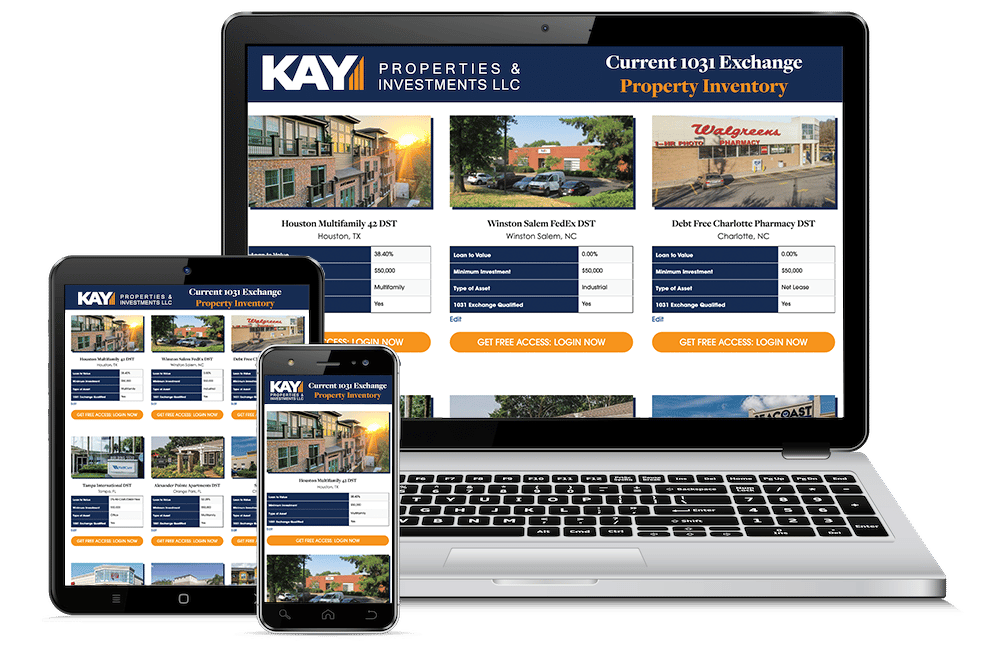

Examples from our DST Marketplace

Net Lease Distribution 53 DST

| Asset Class | Single Tenant Net Lease |

| Leverage | 0% - All-Cash/Debt-Free |

| Location(s) | Rochester, NY |

| Minimum Investment | $50,000 |

| Current Distribution: | Monthly/Inquire |

Dallas Multifamily 59 DST

| Asset Class | Multifamily |

| Leverage | 0% - All-Cash/Debt-Free |

| Location(s) | Dallas-Fort Worth MSA |

| Minimum Investment | $25,000 |

| Current Distribution: | Monthly/Inquire |

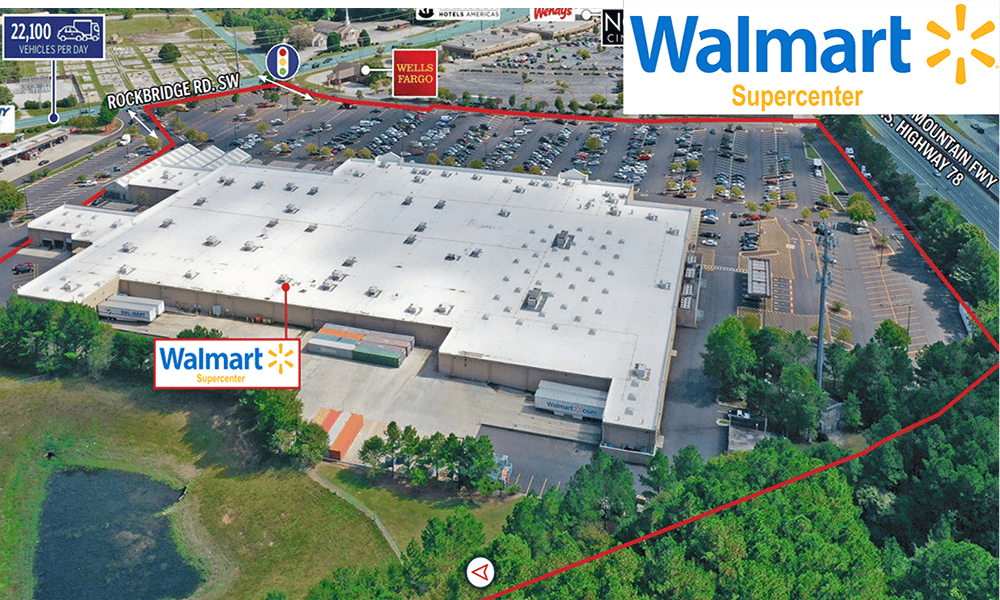

Atlanta Walmart DST

| Asset Class | Single Tenant Net Lease |

| Leverage | 0% - All-Cash/Debt-Free |

| Location(s) | Atlanta, GA |

| Minimum Investment | $100,000 |

| Current Distribution: | Monthly/Inquire |

Parkdale Commons Opportunity 62 DST

| Asset Class | Retail |

| Leverage | 0% - All-Cash/Debt-Free |

| Location(s) | Waco, TX |

| Minimum Investment | $50,000 |

| Current Distribution: | Monthly/Inquire |

Greenville Storage DST

| Asset Class | Self Storage |

| Leverage | 0% - All-Cash/Debt-Free |

| Location(s) | Greenville, SC |

| Minimum Investment | $100,000 |

| Current Distribution: | Monthly/Inquire |

Net Lease Distribution 64 DST

| Asset Class | Industrial Net Lease |

| Leverage | 0% - All-Cash/Debt-Free |

| Location(s) | Frankfort, NY |

| Minimum Investment | $25,000 |

| Current Distribution: | Monthly/Inquire |

*Distribution is not guaranteed and is subject to available cash flow. Please read the Private Placement Memorandum.

Our Client Testimonials Speak for Themselves...

Chay Lapin was an invaluable resource for me as he helped me work through my recent exchange. He was very accessible and worked hard to find just the right replacement property to meet my needs. He also had technology that made finding the right match to my set of unique numbers, so much easier. I would recommend him to anyone with this particular need.

Vera D., Palo Alto, CA

“I would like to express my appreciation for exemplary service from Jason Salmon. I was a novice to the world of the DST and 1031 exchange process. Jason worked with me every step of the way to guide me through what was initially for me, a very confusing and intimidating investment vehicle. He exhibited great patience and knowledge to help me achieve my goals. I look forward to working with Jason again in the future."

Ronald J., Westhampton Beach, NY

“Hi, Betty: Thanks for all the help and guidance into the world of the Delaware Statutory Trust. The assistance helped me make de-cisions which will affect my legacy for my children, and my philan-thropy for the years to come. Thanks to you and Orrin, I didn’t wind up with just one Pizza Hut ,but with some real estate which might fuel some of my larger dreams. The education is invaluable. I hope to see you more frequently.”

Dr. Paul E., Ed.D, Washington D.C.

Kay Properties is a national Delaware Statutory Trust (DST) investment firm. The www.kpi1031.com platform provides access to the marketplace of DSTs from over 25 different sponsor companies, custom DSTs only available to Kay clients, independent advice on DST sponsor companies, full due diligence and vetting on each DST (typically 20-40 DSTs) and a DST secondary market. Kay Properties team members collectively have over 400 years of real estate experience, are licensed in all 50 states, and have participated in over $30 Billion of DST 1031 investments.

This material does not constitute an offer to sell nor a solicitation of an offer to buy any security. Such offers can be made only by the confidential Private Placement Memorandum (the “Memorandum”). Please read the entire Memorandum paying special attention to the risk section prior investing. IRC Section 1031, IRC Section 1033 and IRC Section 721 are complex tax legal codes therefore you should consult your tax or legal professional for details regarding your situation. There are material risks associated with investing in real estate securities including illiquidity, vacancies, general market conditions and competition, lack of operating history, interest rate risks, general risks of owning/operating commercial and multifamily properties, financing risks, potential adverse tax consequences, general economic risks, development risks and long hold periods. There is a risk of loss of the entire investment principal. Past performance is not a guarantee of future results. Potential cash flow, potential returns and potential appreciation are not guaranteed. By visiting the KPI1031.com site, other affiliated portals, or corresponding on pages herwithin, you are opting for communications on behalf of Kay Properties and Investments, or its affiliated companies.

Nothing contained on this website constitutes tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FNEX Capital, member FINRA, SIPC.