According to Dwight Kay, CEO and Founder of Kay Properties, this unique asset was an all-cash acquisition and is considered a high-quality Delaware Statutory Trust for 1031 exchange and direct cash investors.

“From an investment perspective, this property has some characteristics that we believe could potentially bode well for investors. For example, the 102-unit building was constructed in 2014 and has a net rentable area of 96,184 square feet. The property also has a diverse mix of dwelling units, including studio, one-, two-, and three-bedroom floorplans, townhomes, and a penthouse. This diverse selection perfectly aligns with the dynamic demographics of the area. The property is located on 2.69 acres of land in the thriving San Antonio, TX MSA, considered one of the fastest growing cities in the U.S. with strong economic anchors in government, military, and healthcare. Finally, the building and 127 parking spaces are located inside a gated perimeter, providing secure grounds for our tenants,” said Kay.

Kay explained that the DST sponsor company, Cove Capital Investments, immediately inserted its own property management team with over 40 years of experience to oversee the day-to-day management of the asset. This property management team physically lives in San Antonio, ensuring a thorough understanding of the market dynamics and providing true boots and eyes on the ground.

“When you acquire a multifamily property, you must recognize that it is a living, breathing asset that needs close attention to daily operations. We feel confident that Cove Capital’s property management team will waste little time making a significant impact on the property with multiple items for repair and refurbishment underway within less than 1 week of ownership of the asset since closing,” said Kay.

In addition to the investment fundamentals of the San Antonio Multifamily 74 DST, several architectural aspects make this property a unique investment opportunity for 1031 Exchange investors.

“For example, this asset was originally constructed as a peanut processing plant and then converted into ‘The Peanut Factory Lofts’ - a Class-A apartment community in 2014. The unique history of the building, combined with its proximity to San Antonio’s trendy Southtown, Historic King William District, Blue Star Arts Complex, and Historic Market Square, gives the building a distinct contemporary-urban aesthetic. The building incorporates some of the original silos, now transformed into modern apartments, along with a highly sought-after three-bedroom penthouse with a balcony and rooftop access, which commands peak rents for the property,” explained Chay Lapin, President of Kay Properties.

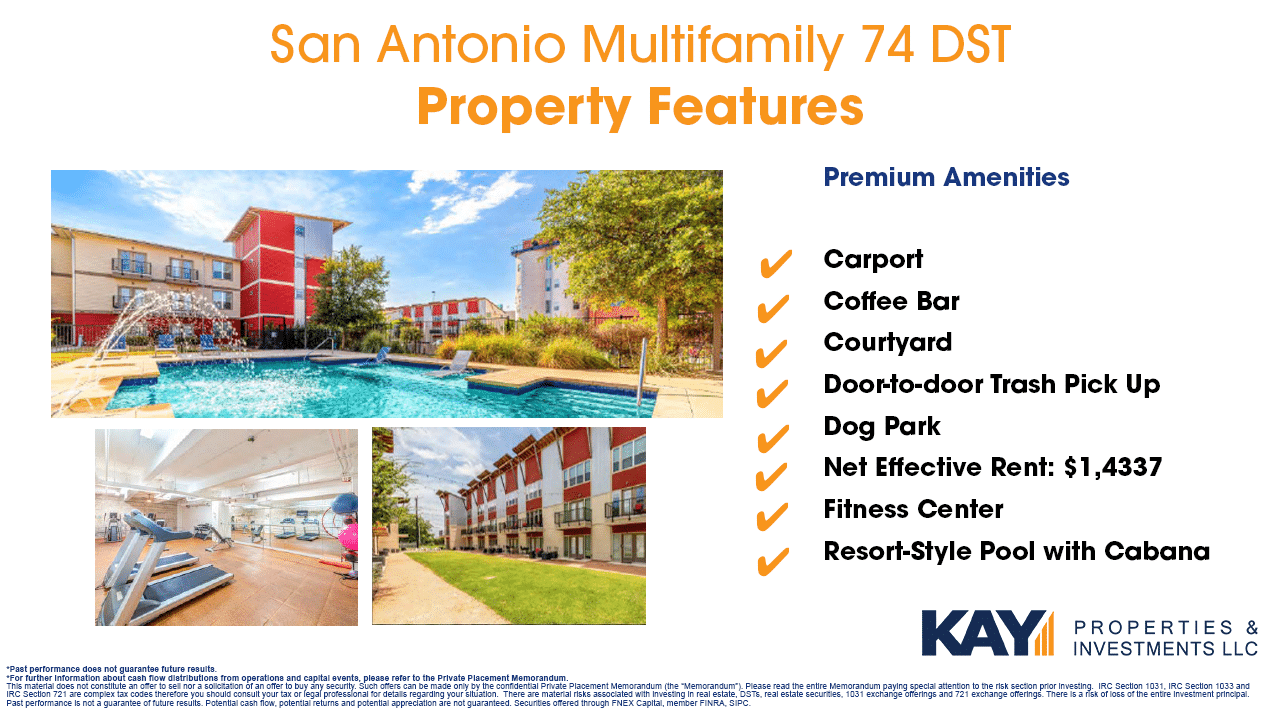

Lapin pointed out that this new Delaware Statutory Trust addition to the kpi1031.com marketplace also offers a host of premium amenities, including private garages, a coffee bar, a courtyard, door-to-door trash pick-up, a dog park, a fitness center, and a resort-style pool with cabana.

“Like many commercial and multifamily sellers today, this investor was coming up on a loan maturity date and potentially facing a foreclosure situation. As all-cash buyers, Cove Capital Investments was able to give the seller confidence that we would indeed close on the asset. The firm’s debt-free platform was critical to successfully acquiring this San Antonio Multifamily DST,” said Lapin.