What are Small Bay Industrial Real Estate DST Investments?

Small bay industrial DST properties are distinguished by their smaller square footage and ability to accommodate a large variety of diverse tenants. Ranging typically from 25,000 square feet to 75,000 square feet in size, with tenant spaces typically between 1,000 square feet to 10,000 square feet, these small bay industrial properties are designed with smaller, more flexible layouts and suite sizes, allowing them to accommodate a wide range of users that can range from artisans to last mile e-commerce distribution nodes.

The ability to pull from a wide range of tenants in today’s market makes the small bay asset class attractive to investors searching for downside risk protection and a growing level of demand for their buildings space. Small bay industrial as an asset class has a wide variety of potential tenants which helps to 1) keep vacancy low 2) provide for flexible use of the space and 3) allow the lease turnover time between tenants to be an often potentially much shorter time frame than their bulk distribution warehouse cousins.

Tenancy at small bay industrial Delaware Statutory Trust investments often may include a wide array of tenants. A small sampling of these potential clients include:- E-commerce fulfillment businesses

- Trade and Construction Companies (HVAC, roofing, electrical and plumbing contractors)

- Landscaping and Irrigation Companies

- Auto Detailing Services

- Custom Metal Fabrication Shops

- Food production and Commercial Kitchens

- Food and Beverage Storage and Supply Companies

- Printing and Packaging Businesses

- Pet Day Care Facilities

- Breweries

- Mixed Martial Arts (MMA) Gyms

- Dance Studios

- Cross Fit Gyms

- Research and Development (R&D) Firms

- Film and Photography Studios

- Robotics and Automation Firms

- Custom Furniture and Cabinet Firms

- 3D Printing Facilities

- Showroom/Warehouse Hybrid Retailers

- Home Improvement Suppliers

- Automotive Repair

- Personal Training

- Third-Party Logistics Providers (3PL)

- Medical Supply Distribution

- Art Galleries and Sculpture Studios

- Pickleball Courts

- Restaurants and Coffee Shops

- Traditional Office Users Wanting Lower Rent than Traditional Office Space

- Churches

This wide array of tenants needing these small bay flexible spaces makes the asset class a truly attractive one for a landlord (or in this case a DST investor) that wants to own a piece of real estate with a wide net of potential tenants that would be interested in leasing space in all different types of economic environments.

Another unique feature inherent to small bay industrial facilities is their strategic placements in infill locations, close to consumer traffic. This proximity to urban cores makes them ideal for "last mile" distribution centers, as they are situated just a short distance from the ultimate destination of products—consumer homes and businesses. By being closer to end-users, these facilities enhance delivery speed and efficiency, catering perfectly to the demands of modern e-commerce and quick-turnaround logistics.

Macro Trends Positively Impacting Small Bay Industrial Real Estate

Taking a sweeping drone's eye view of the industrial real estate landscape, there are several macro trends that bode well for the small bay industrial real estate asset class.

First, the E-commerce boom has been a significant driver in the demand for small bay industrial assets. Because consumers demand faster delivery times, demand from e-commerce businesses searching for last-mile distribution hubs located closer to urban centers has boosted the strategic importance of smaller industrial facilities. Small bay industrial properties are perfectly suited for this role, providing the necessary proximity to consumer markets, and the flexibility to accommodate a wide variety of business models and their respective inventory turnover requirements. This trend is expected to continue as online shopping becomes even more ingrained in consumer behavior.

Another major trend that is fueling the popularity of this small bay industrial asset class is the rise of small and medium-sized enterprises (SMEs). According to a recent article in Reuters1, entrepreneurship in the U.S. surged to an average of 430,000 new business applications per month in 2024, a 50% increase over 2019. This trend reflects a dynamic and growing SME sector that is significantly contributing to economic growth and heightening the need for flexible business operations like small bay industrial spaces. In addition, SMEs need adaptable spaces that can grow or shrink in lockstep with their business needs. Small bay properties offer the perfect solution, allowing businesses to modify layouts without incurring significant overhead that larger industrial facilities face.

Why Small Bay Industrial Assets Appeal to Delaware Statutory Trust Investors

Small bay industrial properties have captured the spotlight among DST real estate investors because they offer multiple advantages that their much larger, single-tenant industrial facility relatives can’t provide.

For one, the average large industrial facility is typically occupied by a single tenant that has a 5–15-year long-term NNN lease in place. However, small bay industrial assets generally have shorter weighted average lease terms (WALTs) that are often 1 to 3 years in duration. This potentially benefits investors on two fronts. The first is that these shorter lease terms can often increase property values in a rising rent environment as the DST sponsor is able to potentially bring under market rents to market creating a potentially increased Net Operating Income (NOI) at the asset level. Increased NOI often means increased values, something all DST investors appreciate. In addition, shorter lease terms provide owners the ability to adjust rents more quickly, providing some inflation protection that longer-term leases in larger industrial buildings can’t match.

Lower Tenant Improvement Costs

Small bay industrial properties offer a unique value proposition for both tenants and investors, particularly in challenging economic environments. One of the big advantages of the small bay industrial asset is that they generally have lower tenant improvement (TI) costs compared to large bulk distribution facilities and other real estate asset classes such as medical, office and retail.

Small bay industrial spaces typically require minimal customization, making them far more cost-effective for tenants to occupy. This reduced upfront investment can be especially appealing to small and mid-sized businesses looking to optimize their operational expenses. For landlords, lower TI costs mean faster lease-up times and reduced capital expenditures, making the small bay industrial asset a potentially more efficient investment model than larger industrial assets and other asset classes.

Lower Rental Rates

Another compelling feature of small bay industrial properties is their lower rental rates compared to traditional office or retail spaces. In a slow or difficult economy, businesses are increasingly cost-conscious, and small bay industrial facilities provide an affordable alternative for users seeking functional space without the more expensive rental rates of office or retail locations. For example, according to a survey conducted by Costar, current asking rental rates for small bay industrial spaces typically range from $7.92 - $14.55 per square foot per month, significantly lower than traditional office spaces, which can range from $39.42 - $41.39 per square foot per month, and prime retail spaces, which often command $40 - $100 per square foot per month. This affordability, combined with the flexibility of the space, helps create strong demand and potentially more consistent occupancy rates, even during economic downturns.

The Benefit of NNN Leases in Small Bay Industrial Assets

Small bay industrial properties are also highly attractive to investors due to their prevalence of triple net (NNN) leases. Under these lease structures, tenants are typically responsible for maintenance, property taxes, and insurance for their portion of the space, rather than the landlord. This arrangement can potentially create a more stable form of income and offset a significant portion of operating expenses that landlords typically bear in other asset classes such as apartments, hotels, self-storage and senior care.

In the recent high-inflation environment, NNN leases have served as a critical “anchor” mechanism for investors, helping to protect cash flow from skyrocketing insurance and maintenance costs.

Resiliency of Small Bay Industrial Assets

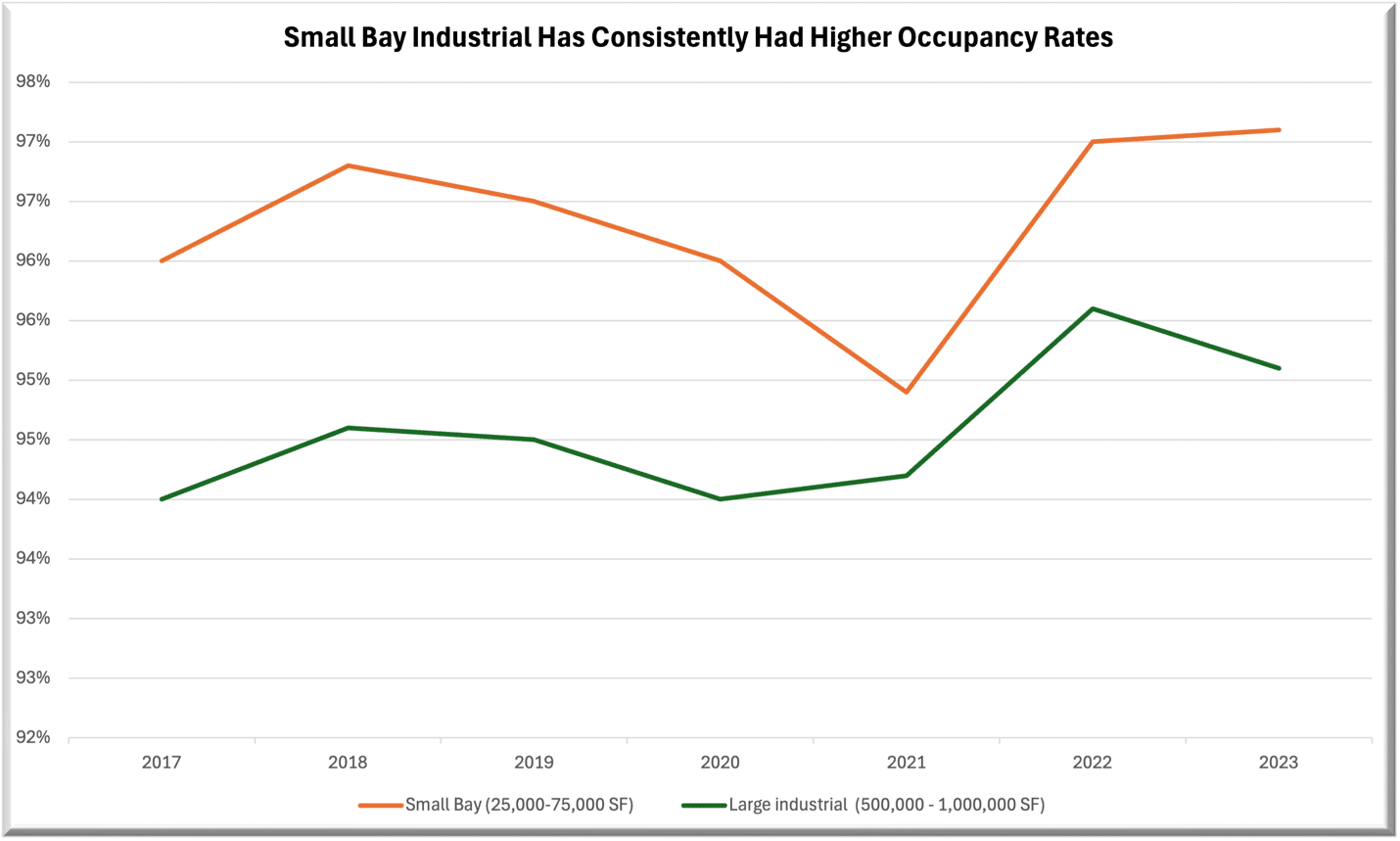

In addition, small bay industrial properties are also incredibly resilient to the ebb and flow of economic tides because they have a higher number of leasing opportunities due to the vast array of tenants that typically rent these smaller spaces compared to single-tenant large industrial properties, which often require a very specific tenant to fill a 100,000 to 300,000 square foot space. As a result, the small bay industrial asset class attracts a broader range of leasing prospects, leading to a potentially more consistent demand across a diverse mix of tenants, regardless of market conditions or cycles.

* past performance does not guarantee future results.

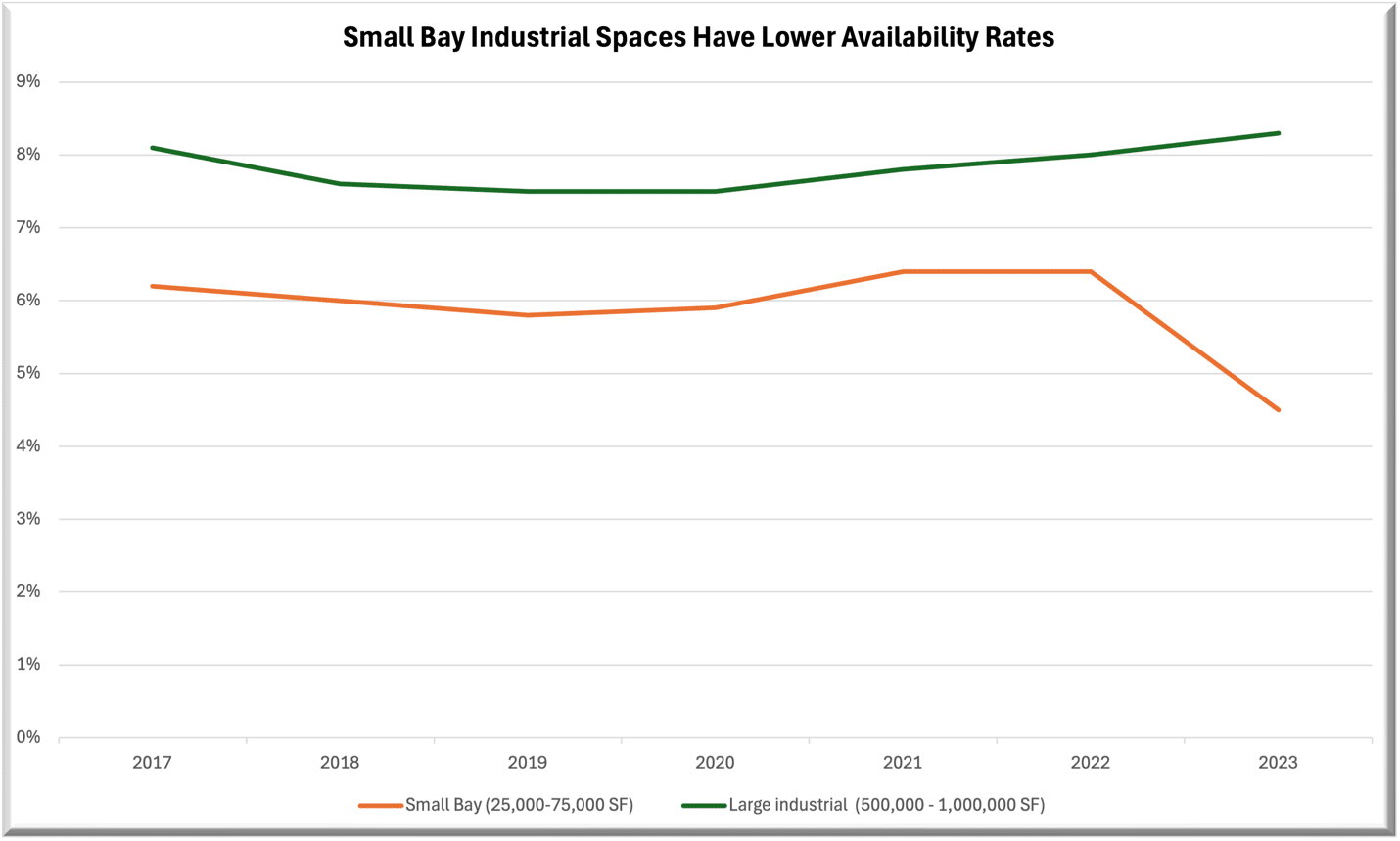

Finally, the economic theory of "supply and demand," first articulated by Scottish economist Adam Smith in his landmark work, The Wealth of Nations, hints at another key benefit for small bay industrial properties.

Lack of suitable land and urban zoning restrictions have placed high barriers to new construction which drives demand, rent growth, and appreciation.

Examples of Small Bay Industrial Real Estate Assets on the Kay Properties Online Marketplace at www.kpi1031.com

Texas Small Bay Industrial 86 Portfolio DST

Investment Summary:

This small bay industrial portfolio DST offering is a fully debt-free investment that was created with the purposeful investment strategy of mitigating common risks associated with real estate debt, such as mortgage foreclosure, cash flow sweep clauses, and go-dark provisions.

Investors can sleep well at night knowing there is no lender on the buildings.

The next Small Bay offering available on the www.kpi1031.com marketplace is the Texas Small Bay Industrial 85 Portfolio DST

Investment Summary: