By Dwight Kay, Founder and CEO, Kay Properties & Investments

Are you a 1031 exchange investor who is confused about what is a Delaware Statutory Trust, and how it can potentially help you. If so, then read on because this article will not only tell you what a Delaware Statutory Trust is, how they can be used in a 1031 Exchange, and what are the key issues to consider prior to understanding are DSTs good investments for your 1031 exchange.

In general, DST investments can be a great way to build equity and even provide significant tax advantages to those involved. That being said, there are many details and considerations to pay attention to before getting involved in a DST.

Let’s Answer What is a Delaware Statutory Trust?

The first step to investing in a DST is to know how to define it:

A Delaware Statutory Trust is a legally recognized trust that is set up for the purpose of business. A DST does not need to be set up in Delaware, nor even in the U.S.A. In some instances, DSTs are referred to as an Unincorporated Business Trust or UBO. It was created in 1988 as the Delaware Business Trust Act and later called the Delaware Statutory Trust Act in 2002.

The main distinguishing factor of a DST is that it is formed as a private governing agreement under which DST investment property is held, managed, invested, and operated by a small group of trustees.

In some ways, you can think of a DST as a limited liability partnership (LLC) where multiple owners invest fractional interests together into an asset that is managed by a master partner. Similar to an LLC, the DST provides owners with limited liability and divides income through the minority owners.

At Kay Properties, we specialize in helping investors understand what DST investments are and how they can make their own DST investment.

You can view our free listings of DST 1031 properties here.

What is a DST in Real Estate?

Delaware Statutory Trusts are often used in real estate investing to allow multiple investors to pool money together in exchange for small holdings of the trust.

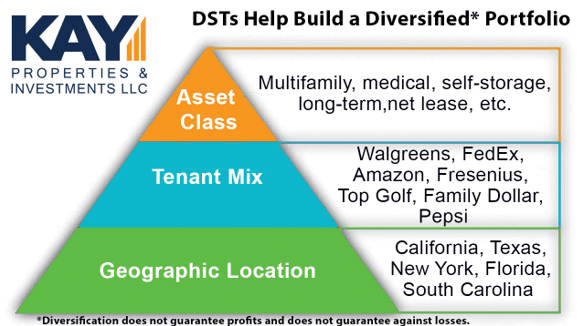

In 2004, the IRS ruled that ownership interests within a DST qualify as a like-kind property that can be used in a 1031 exchange out of a DST. This allows real estate sellers to defer capital gains, step away from active property management, and create the potential for greater diversification by investing in properties in multiple geographic regions, across different asset classes, among a variety of tenant mixes.

DSTs require an appointed trustee to reside over the DST investment. Other investors, apart from the appointed trustee, do not have decision making power within the investment. The appointed trustee also has limited power over the investment.

For some investors, this might be considered a downside because they are not used to passive management.

What is a DST 1031 Exchange?

In a DST 1031 exchange, the property seller is allowed to move funds from an asset’s profit into a new like-kind property without paying capital gains taxes.

1031 exchanges are often thought of as tax-deferment agreements because any seller that enters a 1031 exchange will technically need to pay the capital gains tax on disposition of the asset.

Typically, DST 1031 exchanges have a minimum investment of $100,000. This allows investors to diversify their exchange proceeds throughout multiple properties. The normal loan to value of a DST 1031 property is 50% however it is not uncommon to see DST properties offered all cash/no debt to minimize financing risks.

What are the Delaware Statutory Trust Requirements

If you are an investor who is interested in how to set up a Delaware Statutory Trust, it is important to recognized that Delaware Statutory Trust investments are subject to governing laws. The following laws state what can and cannot be done in a DST investment:

- The trustee cannot accept future equity contributions after the offering is closed. This includes equity contributions from existing DST investors.

- No additional debt financing can be procured for the investment. No new terms may be negotiated on existing loans.

- Proceeds from the sale of the investment may not be reinvested. All proceed must flow back to the investors of the DST.

- Capital expenditure of the property can only be made by the trustee for the following reasons: (1) normal maintenance and repairs of the property, (2) small, non-structural capital improvements, (3) capital expenditure as required by law.

- Between distribution dates, all liquid cash held by the DST can only be invested in short-term debt obligations.

- Liquid cash held by the DST must be distributed to the investors on a regular basis.

- No new leases or lease renegotiations may be entered into by the trustee, unless approved under a master leasing agreement at the inception of the DST. The trustee may, however, execute a new lease if the existing tenant defaults on its lease.

What to Know When Considering Setting up a DST

Because of the nature of the trustee and investor relationships within a Delaware statutory trust, it is important to choose your sponsor firm wisely. A competent trustee will be the difference between success and failure in your DST.

If for some reason the trustee feels the DST is at risk of losing the property because of management issues, the trustee can convert the DST into an LLC within control provisions. When this happens, DST investors will be forced to pay the capital gains tax immediately.

Finally, when considering a DST property, keep in mind that the limited controls offered within a DST make certain types of investments more efficient.

The easiest properties to manage under a DST include properties where minimal leasing and management is required. This can include single tenant or triple-net leased properties that do not have a near-term lease expiration.

Current DST 1031 Properties

Kay Properties currently has a wide array of DST properties available in our listing service. Our marketplace showcases DSTs from over 25 sponsor companies. We also offer a wider array of custom DSTs available to Kay clients.

Kay Properties team members collectively have nearly 400 years of real estate experience, and have participated in over 30 Billion of DST 1031 investments. Contact us to learn more about how we can help you in your next DST investment.