By Dwight Kay, Founder and CEO, Kay Properties and Investments

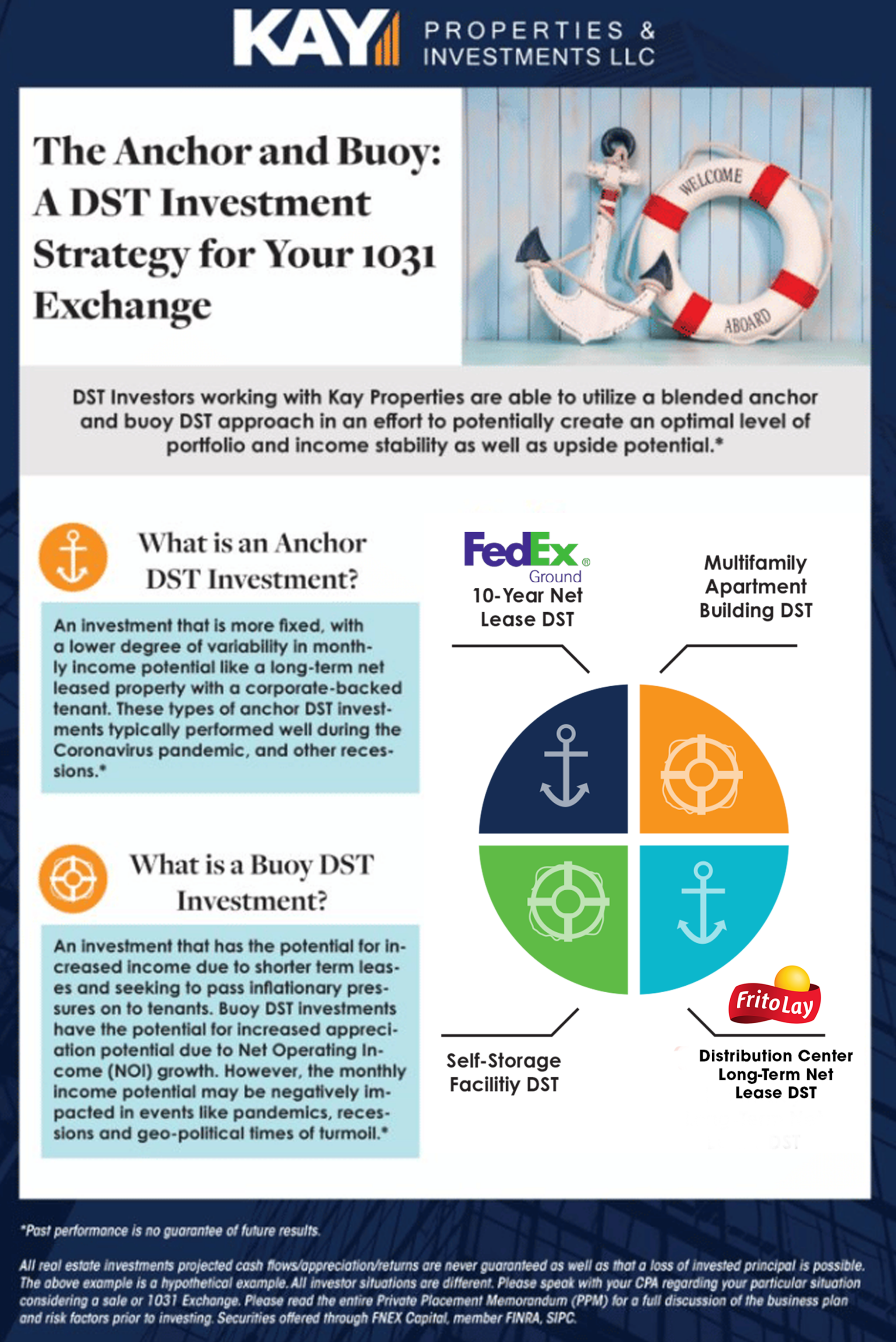

Real estate investors currently considering a Delaware Statutory Trust (DST) investment for a 1031 exchange or even a direct-cash investment, one of the first things to consider is what specific investment strategy should you pursue? For example, is the goal to achieve greater appreciation even if it means investing in an asset that carries greater risk? Or is your long-term strategy to have steady monthly income even if it means lower overall appreciation potential? I like to call this the “Anchor and Buoy” investment theory. One of the beautiful things of Delaware Statutory Trust investments is that they can potentially provide investors both the benefits of the anchor and buoy investment strategies.

How “Buoy” Investments Work for Your Delaware Statutory Trust

To better understand how to use the anchor and buoy theory to evaluate potential DST investments, consider a multifamily building that has 500 tenants. First, while residential properties use comparable sales or “comps” to approximate valuation, multifamily properties are also valued based on the amount of Net Operating Income (NOI) they produce. NOI is calculated by subtracting a property’s operating expenses from its gross income. Gross income is derived from the sum of all sources of income for the multifamily property. While the vast majority of income comes from rent payments, there could also be ancillary sources of income like covered parking fees, laundry/vending income, pet rent income and even rent for storage unit access. On the flip side, operating expenses are the costs required to run the multifamily property on a day-to-day basis. Although these amounts will vary depending on the type of building, the line items will be typically very similar. These can include things like utilities, taxes, insurance, maintenance, property management, and even legal fees.

In this example, the multifamily building has a diversified tenant base of 500 tenants that are paying rent each month. Additionally, because most multifamily assets use an annual lease, landlords have the opportunity to potentially increase those leases every year. In addition, any vacancies can provide owners the opportunity to potentially raise rents when filling the vacancy. In this way, multifamily properties act like a buoy, moving and adjusting with the conditions.

While all real estate investments have some form of material risks associated with them like interest rate risks, vacancies, general market conditions, and financing risks, many investors like assets like multifamily and self-storage because they have the potential to gain more appreciation over time as they hopefully are able to increase their income generated through rental increases over the years. In addition, multifamily and self-storage are considered good “buoys” to potentially hedge against inflation because owners can hopefully raise the rents each year to help offset rising costs.

Why Multi-Family and Self-Storage are Considered Good Buoy DST Investment

Many investment professionals and accredited investors view self-storage and multifamily markets through the same investment lens. First, both asset classes follow a similar set of metrics to help determine market favorability, including demographic trends and income statistics. Second, both multi-family and self-storage use rent growth and vacancy rates as a way to project future performance. Finally, as mentioned earlier both asset classes are considered to be somewhat recession-defensive, and because operators are able to quickly respond to changing market conditions with rent changes, both property types are also considered to be an inflation hedge option in commercial real estate.

Example of Buoy Multifamily Delaware Statutory Trust Investment

A good example of a buoy DST investment would be Dallas Multifamily 59 DST, a debt-free, unleveraged DST investment currently being offered to accredited investors by Kay Properties.

You can learn more about this Buoy investment by watching this video:

What is an Example of an Anchor Delaware Statutory Trust Investment?

So, if a multifamily building is considered a “Buoy” DST investment, then what is an “Anchor” DST investment? Many investors consider a commercial net lease type of asset as more of an anchor investment for their DST 1031 Exchange investments. First of all, instead of using NOI and market capitalization rates (cap rates) solely as a valuation measurement, most commercial net lease assets are going to additionally tie the valuation of the property with the creditworthiness of the tenant. For example, Joe’s Pizza Shop is not as creditworthy of a tenant as FedEx or Walgreens, both of which are considered investment grade tenants. First of all, Joe’s Pizza Shop can shut down and investors are left with an empty building and the potential for expensive maintenance costs and unpaid rent. While it is possible that FedEx or Walgreens can also shut down a location, the odds are that these multi-billion dollar public companies will continue to pay rent as they have investment grade credit ratings by Standard and Poor’s (S and P).

Why are Long-Term Net Lease Commercial DST Buildings Considered Anchor Investments?

In addition to the creditworthiness of the tenant, anchor investments also use the length of the lease as another important factor to take into account. For example, a FedEx distribution center with a 10-year lease is an inherently valuable asset because there are 10-full years of potential income that has a corporate guarantee on the lease to pay the landlord the predetermined amount each month. However, while this type of asset can act as an anchor over the course of many years, there is typically not an opportunity to raise rents as can be found in multifamily or self-storage facility DST investments.

Example of an Anchor Long-Term Net Lease Delaware Statutory Trust Investment

A good example of a buoy DST investment would be Pharmacy Net Lease 46 DST, a debt-free, unleveraged DST investment currently being offered to accredited investors by Kay Properties.

You can learn more about this Anchor DST investment by watching this video:

How Delaware Statutory Trust Investments Blend Both Anchor/Buoy Philosophies

DST investments provide investors several ways to incorporate both anchor and buoy investment strategies by incorporating diversification into a real estate portfolio. For example, DSTs can create diversification through geography, property type, and investment structure.

-

- Geography

The beautiful thing about Delaware Statutory Trust investments is they can hold real estate assets in any state across America, helping investors target properties in specific markets where they believe will deliver a desirable combination of ongoing income and potential appreciation. For example, investors might decide to invest in tax-friendly, high-growth states like Texas, Florida, or North Carolina among others.

- Geography

-

- Property Type

Delaware Statutory Trusts also allow investors to achieve the potential for greater diversification through property types as well. For example, DSTs can include a wide range of asset types including apartments, distribution centers, medical buildings, and self storage facilities. Essentially any asset that can qualify as a “like kind” 1031 exchange property can potentially be structured as a DST.

- Property Type

-

- Investment Structure

Another way DSTs help investors incorporate both anchor and buoy investment strategies is through investment structure. A good way to explain this is to recognize that while many DSTs consist of a single property, other DST investments consist of a larger portfolio of similar assets e.g., multiple apartment complexes, self-storage facilities, office buildings, or retail properties. In this way, a DST portfolio can create a “built-in” diversification component that many investors find attractive.

- Investment Structure

In conclusion, an investor could place their entire exchange proceeds into a multifamily or self-storage DST if they were seeking greater upside potential that the buoy strategy is seeking. The downside is that if the economy were to suffer, if another pandemic or any other myriad of black swan events were to happen that investor could easily see cash flow cut in half or suspended entirely. So in an effort to enhance appreciation potential the investor sacrifices the stability of income that many investors are seeking in today’s volatile environment.

However, many investors these days are achieving the goal of potential appreciation by utilizing the buoy investment strategy of multifamily and self storage DSTs and at the same time blending in the anchor strategy in an effort to gain potential stability of income by utilizing long-term net leased DSTs with tenants such as FedEx and Walgreens. This blended anchor and buoy combination strategy is gaining popularity as investors consider where we are in today’s economic and geopolitical environment.

To see a complete list of anchor and buoy DST properties and other real estate investment options, please visit www.kpi1031.com.