By: Jason Salmon, Executive Vice President, Managing Director, Kay Properties and Investments

A Look at the 1031 Exchange Basics:

If you own investment real estate – whether a rental condo or home, apartment building, a commercial building, raw or vacant land or otherwise—you do not have to pay taxes when you sell the property. Uncle Sam has had section 1031 of the Internal Revenue Code in place since 1921. Also known as a 1031 exchange, this provision allows a seller of property held for investment or business purposes to “replace” their “relinquished” property in a “like-kind” exchange.

The 1031 exchange process enables investors to preserve more of their capital for further investment opportunities and creating the potential for greater portfolio growth and asset diversification.

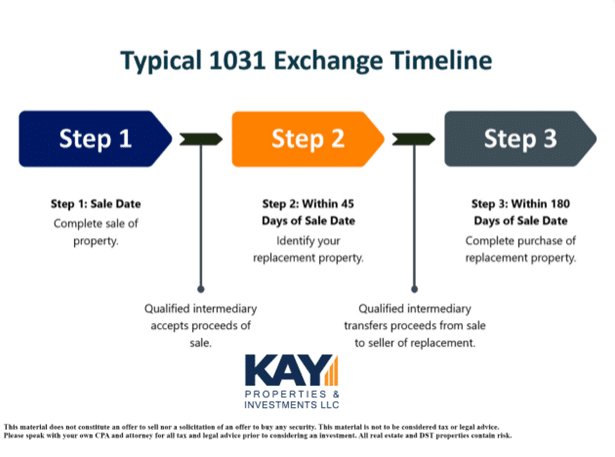

However, it is very important to note that a 1031 exchange must adhere to very specific IRS guidelines, including a designated time frame for identifying and closing on the replacement property, and the involvement of a qualified intermediary to oversee the transaction.

Here is a quick look at some key rules and requirements surrounding a 1031 exchange:

- Like-Kind Property Requirement: The properties involved in a 1031 exchange must be of "like-kind." This means that any type of investment real estate can be exchanged for another investment property. For example, a residential rental property can be exchanged for a commercial office building.

- Identification of Replacement Property: The investor must identify the replacement property or properties within 45 days of the sale of the relinquished property. There are two common identification rules: the Three-Property Rule (identify up to three potential properties) or the 200% Rule (identify any number of properties, but their total value cannot exceed 200% of the relinquished property's value).

- Acquisition Deadline: The investor must close on the replacement property within 180 days of the sale of the relinquished property, or by the due date of the investor's tax return for the year in which the relinquished property was sold, whichever comes first.

- Equal or Greater Value: The value of the replacement property or properties must be equal to or greater than the relinquished property's value. In addition, any funds not used to acquire the replacement property is called a “boot”, and will be subject to capital gains tax.

- No Personal Use: The properties involved in the exchange must be held for productive use in a trade or business, or for investment purposes. Personal residences do not qualify.

- Use of a Qualified Intermediary: A qualified intermediary (QI) must be used to facilitate the exchange. The QI holds the funds from the sale of the relinquished property and disburses them for the purchase of the replacement property, ensuring that the investor does not have direct access to the funds.

- Same Taxpayer Requirement: The taxpayer who sells the relinquished property must be the same taxpayer who acquires the replacement property. It's important to note that this refers to the taxpayer's legal entity (e.g., individual, partnership, corporation), not necessarily the individual's name.

- Proper Titling: The title on the replacement property should be taken in the same manner as it was held on the relinquished property. For example, if the relinquished property was held by an LLC, the replacement property should also be held by the same LLC.

The Importance of Deferring Taxes:

A Quick Example by the Numbers:

The 1031 Exchange and Estate Planning:

Why an Exit Strategy Is Critical for Maximizing Value:

More Than One Option When Using the 1031 Exchange:

- One way is to find an asset with active management responsibilities—that means tenants, toilets and trash. If an investor wants a hands-on property with day-to-day landlord responsibilities, this would be the appropriate way to go.

- Another is a passive real estate investment—a net-leased asset, specifically NNN (triple-net) real estate passes through taxes, insurance and property maintenance expenses to the tenant that occupies the property. These types of investments can be attractive, but the investor must be sophisticated and understand the space (i.e., lease negotiations for renewals, how inflation affects value, financing implications, etc.).

- There are also truly passive real estate investments that allow those in 1031 exchanges (as well as those wishing to make a direct cash investment) to own a fractional interest in a large institutional asset or portfolio of assets. Utilizing this strategy allows an investor to diversify across multiple asset classes, geographies and asset managers. The structure that is often used for this model is a Delaware Statutory Trust or DST.